So, a crypto token you'd never heard of until five minutes ago rallied 130% in a month. The headlines are breathless, the Twitter gurus are pounding their chests, and you're supposed to be impressed. You're supposed to feel that familiar pang of FOMO, that little voice whispering, “You missed it again.”

Let’s be real. Celebrating a 130% pump in the crypto casino is like being impressed that the sun came up. It’s what happens here. A coin named Adrena (ADX) shot up in September, and the "experts" are scrambling to reverse-engineer a narrative for it. They point to a trading raffle, a vague teaser about "4 things coming soon," and a surge in the broader Solana ecosystem.

Give me a break. That’s not a fundamental reason for a rally. That’s a marketing checklist.

Imagine some trader, hunched over his monitor in a dimly lit room, the glow of the charts reflecting in his glasses. He sees the green candle, the volume spike, and the chatter on Discord. He doesn't see fundamentals; he sees a rocket ship he's about to miss. That’s the entire business model.

The Anatomy of a "Surge"

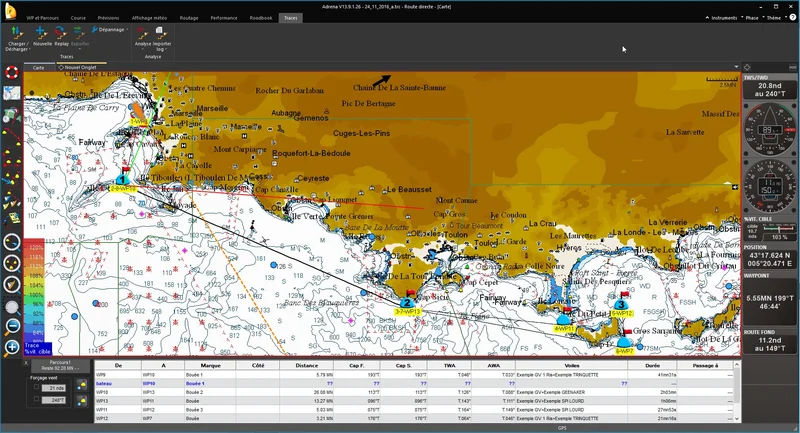

Let's dissect this miracle, shall we? The story they’re selling, as detailed in reports like Adrena ADX Rallied 130% Percent In September, A Deep Dive, is that Adrena, a decentralized perpetuals exchange on Solana, caught fire because of its brilliant strategy and community engagement. The reality is a bit more… predictable.

The rally had three phases, they say. Consolidation, build-up, and then the big one. It sounds so technical, so professional. But when you strip away the jargon, it's the same old playbook. Whales quietly accumulate while the price is flat. Then, a series of perfectly timed announcements creates the spark.

On September 25, an anniversary raffle. The next day, a cryptic teaser. The day after that, a million-dollar liquidity mining program. It's a textbook one-two-three punch designed to manufacture hype. And then came the knockout blow, the piece of information that turns a small fire into an inferno.

A report "revealed" that only 9.4% of all ADX tokens are actually liquid. Over 76% are staked and locked up for an average of 540 days.

This is presented as a bullish sign of holder confidence. It's not. It's a mechanism for engineered scarcity. This is a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of market manipulation disguised as a feature. It's like a game of musical chairs where 90% of the players are chained to their seats. The few people left running around can drive the price of a chair to infinity, but it's a completely artificial market. What happens when those 540-day lockups expire? Does everyone get a Lambo, or do they all stampede for the same tiny exit door?

The low float triggers FOMO, the FOMO drives the price, and the price increase is then used as "proof" that the project is a success. It’s a self-licking ice cream cone of speculation. That ain't investing, that's just gambling with extra steps.

Don't Blame Adrena, Blame the Game

Look, I'm not even singling out Adrena here. They're just the latest actor to nail the part. The entire "Perp DEX narrative" is the hot new thing. DefiLlama data shows trading volume on these platforms surpassed $1.1 trillion in September. Trillion. With a 'T'. Money is sloshing around looking for the next 100x, and projects like Adrena, Perpetual Protocol, and Bluefin are happy to give the people what they want.

It's just so tiresome. I’ve been watching this space for years, and it’s the same cycle over and over. Remember ICOs in 2017? DeFi Summer in 2020? NFTs in 2021? Each time, a new narrative emerges, promising to be the thing that finally changes everything. And each time, it just ends up being a new way to separate hopeful people from their money. Offcourse, some people get rich, but it's usually the insiders and the whales who were buying when the price was flat.

They want you to believe this is about decentralization, about escaping the clutches of big banks and KYC requirements. A noble goal, I guess. But for 99% of the people piling into ADX, the appeal isn't the tech; it's the ticker symbol and the dream of a vertical chart. The platform itself, the actual product, is almost an afterthought.

Then again, maybe I'm the crazy one here. Maybe this time it's different. Maybe a low-float, high-leverage trading token is the key to financial freedom and not just a ticking time bomb of illiquidity. But I doubt it. This all feels so familiar, and honestly...

It's Just Math Dressed Up as Magic

So, are we supposed to be impressed by a 130% rally? No. We're supposed to be suspicious. We're supposed to ask who benefited the most and what happens when the music stops. A price surge driven by manufactured scarcity and a well-timed marketing blitz isn't a sign of a healthy project; it's a sign of a well-played game. It's not an indicator of value, it's an indicator of hype. And in crypto, hype has a notoriously short shelf life.

Tags: Adrena