If you're only looking at Solana's price chart, you're reading the wrong story. The daily candles paint a picture of hesitation, a market stuck in a sideways grind between $220 and $230, looking tired and anemic next to high-flyers like Binance Coin. A trader, hunched over their monitor, sees the SOL/BNB ratio hitting its lowest point since last year and reasonably concludes that capital is fleeing. The narrative seems simple: the momentum is gone.

But that narrative is wrong. It’s a surface-level reading that ignores a powerful undercurrent of data. While retail sentiment chases the next 30-day pump, a different class of participant is moving with conviction. The discrepancy between Solana’s sluggish price and its blistering on-chain fundamentals isn't just noise; it’s one of the most significant tells in the market right now. The market is watching the speedometer flutter, completely ignoring the fact that the engine is redlining and the fuel tank is being topped off by a tanker truck.

The Data Contradiction

Let's start with the obvious friction point. In the last 30 days, BNB posted a 50% gain while SOL managed a paltry 1.5%. That's a performance gap of nearly 33x—to be more precise, BNB’s rally was about 33 times larger. This has driven the SOL/BNB ratio down for four straight weeks, fueling the chatter that Solana has lost its edge. FOMO is a powerful force, and right now, it’s chasing BNB.

But when you look under the hood, the engine tells a different story. This week alone, the Solana network processed 503.6 million economic (non-vote) transactions. That’s more than 4.4 times the throughput of the Binance Smart Chain. At the same time, Solana Exchange Traded Products (ETPs) saw inflows of $706 million, a figure that's 127% above the previous all-time high. This isn't speculative retail money hopping on a trend; this is serious capital making a calculated allocation.

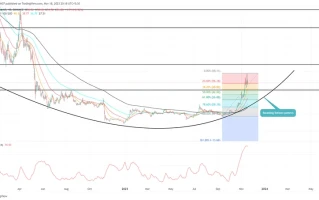

This leads to a fundamental question: If the network is being used exponentially more and institutional products are seeing record demand, why isn't the price reflecting it? Is the market simply inefficient, or does the sheer volume of SOL transactions represent something other than durable economic value? The data suggests a profound disconnect between perceived momentum and actual utility. Solana: Why SOL’s price levels might not reflect its true value

And this is the part of the analysis that I find genuinely puzzling. We have a network with a Total Value Locked (TVL) of $42.4 billion across its top projects, supported by liquidity from giants like Circle and PayPal. Yet, the price action suggests investors are more impressed by a competitor’s short-term rally. It’s a classic case of the market valuing narrative over numbers, at least for now.

Wall Street's Quiet Accumulation

The story gets clearer when you stop looking at the anonymous crypto crowd and start tracking the names. Sharps Technology, a publicly traded company, just announced it has acquired 2 million SOL (valued at over $440 million) and has designated Coinbase as its official custodian. Solana Price Prediction: Public Company Taps Coinbase to Buy Millions in SOL – Wall Street is Here This isn't a degen trader apeing into a meme coin. This is a corporate treasury decision, a multi-year strategic bet on an ecosystem.

Let's deconstruct what that actually means. Using Coinbase as a custodian signals an intention to hold, not trade. It’s about security, compliance, and long-term asset management. Furthermore, the company explicitly plans to stake its holdings, which at current rates of 6.8%, could generate up to $30 million in annual yield. This isn't a price play; it's a cash-flow play. I've analyzed hundreds of corporate treasury strategies, and dedicating this much capital to a single crypto-asset, managed through an institutional-grade prime broker, isn't speculation. It's a structural adoption.

This single move by Sharps Technology is a far more potent indicator of future value than a thousand daily red candles. It represents the quiet, methodical accumulation by entities that operate on timelines of years, not hours. While the retail market is distracted by intra-day volatility and rival-coin pumps, institutional capital is patiently building a foundational position.

This is the real story. It’s not about breaking the $230 resistance tomorrow. It’s about the fact that Wall Street firms are using regulated, on-shore vehicles to buy hundreds of millions of dollars' worth of SOL with the intent to hold and stake. How many other firms are doing this quietly, without a press release? What does the order book at Coinbase Institutional look like right now? Those are the data points that matter.

Price is a Lagging Indicator

The current market is presenting a clear arbitrage opportunity between perception and reality. The perception, driven by short-term price charts and relative performance against peers, is that Solana is stagnating. The reality, evidenced by on-chain transaction volume, record ETP inflows, and nine-figure corporate acquisitions, is that the network's fundamental adoption is accelerating at a pace its token price has yet to acknowledge. The retail market is selling the rumor; institutions are buying the numbers. In this environment, price is not a reflection of current value—it is a lagging indicator of future demand.

Tags: solana price