So, a new crypto darling is born. ChainOpera AI (COAI) just rocketed past a billion-dollar market cap, and the crypto bros on X are losing their collective minds. A 64% surge in 24 hours. Over 1,300% gains in a week. You can almost smell the digital ink on the "crypto is back, baby!" headlines.

Give me a break.

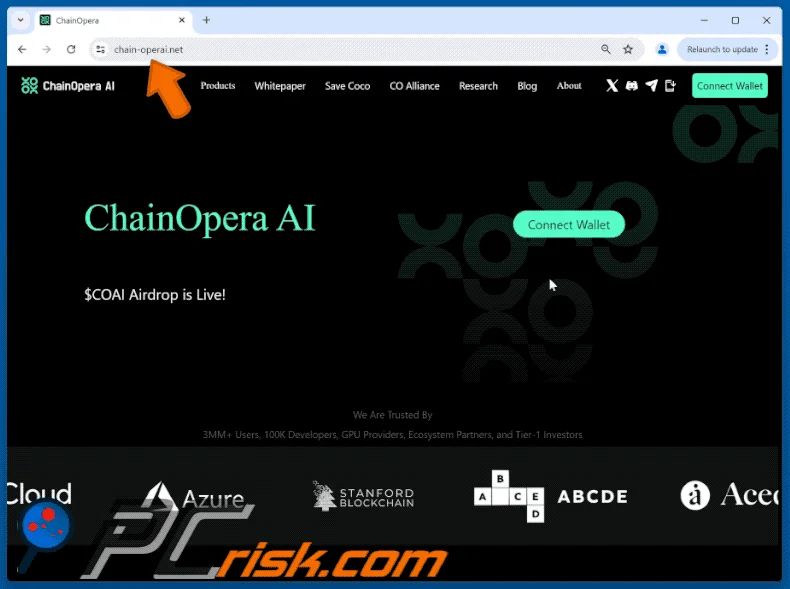

Every time one of these things goes parabolic, we're told it's different. This isn't just a token; it's a "decentralized AI platform" aiming to "foster collaborative intelligence." It sounds impressive, doesn't it? Like something out of a sci-fi movie. They claim to have 3 million AI users and 300,000 paying customers on the BNB chain. Fantastic numbers, if you believe them.

But let's be real. The surge has less to do with some revolutionary AI breakthrough and more to do with perfect timing. It’s riding the coattails of a "BNB Season," getting a boost from Binance founder CZ’s cheerleading, and snagging listings on a few big exchanges. It's the classic crypto playbook: build hype, catch a narrative wave (this time it's AI), and watch the retail FOMO roll in. It’s like putting a "gluten-free" sticker on a candy bar; the underlying product might be junk, but the label sells. Are we really supposed to believe this meteoric rise is purely organic growth? What does "3 million AI users" even mean in this context? Are they active participants, or just wallets that interacted with a smart contract once?

Let's Pop the Hood on This Hype Machine

Alright, let’s stop looking at the shiny new paint job and check the engine. When you do, you don’t find a finely tuned German machine. You find a lawnmower engine held together with duct tape and hope.

First, the token distribution. Oh boy, the token distribution. According to BscScan, the top 10 wallet addresses hold over 96% of the total COAI supply. Let me repeat that, so it sinks in. Ten wallets. The top 100 hold nearly 99.8%. This isn't a decentralized project; it's a private party with a few uninvited guests. This is like playing a game of Monopoly where one person starts with all the hotels on Boardwalk and Park Place. The game is over before it even begins. Attention Required!

The team can talk all they want about being "long-term-oriented," but when a handful of anonymous wallets can crash the price to zero with a few clicks, what does that even mean? One X user put it bluntly: "If these wallets dump, the price could collapse to zero... This isn’t a real pump… it’s pure manipulation." You think?

Then there’s the vesting schedule. CryptoRank data shows that only about 20% of the total 1 billion tokens are even in circulation. The rest are locked up, waiting to be slowly dripped—or fire-hosed—onto the market. This creates a massive gap between the current market cap and the Fully Diluted Valuation (FDV). It’s a ticking time bomb of inflation. New buyers are essentially paying today's prices for an asset that's programmed to become less scarce over time. It ain't rocket science.

This whole thing reminds me of the dot-com bubble. Back then, you could add ".com" to any failing sock puppet company and get millions in venture capital. Now, you just slap "AI" onto a crypto token and pray for a Binance listing. It's the same hustle, just with more complicated jargon. The strategy is to sell the dream of the future to pay for the present.

The Inevitable Hangover

So what happens when the music stops? What happens when the "BNB Season" ends and CZ finds a new shiny toy to promote? Can the supposed fundamentals of Chain Opera AI actually sustain this valuation?

History tells us that projects with this kind of top-heavy distribution and low initial float rarely end well for the little guy. The initial hype, fueled by exchange listings and a hot narrative, creates exit liquidity for the early insiders. You can see the short liquidations piling up—over $17 million—which just adds more fuel to the fire, pushing the price even higher in a classic short squeeze. It's a feedback loop of pure speculation.

The project claims its success is because they "happened to be building on BSC." That's not a strategy. No, that's not right—it is a strategy, just not a technological one. It's a marketing strategy. They got lucky with their timing and location, and now they're spinning it as genius.

But what is the actual product? A network of "AI agents" and a chat platform. Groundbreaking stuff, I'm sure. We offcourse have no shortage of those. The question nobody seems to be asking is whether the demand for the COAI token is driven by genuine utility within this ecosystem, or by speculators betting the number will go up. I think we all know the answer.

Then again, maybe I'm just a jaded cynic. Maybe those ten wallets are controlled by the ten most benevolent people on Earth who would never dream of cashing out. Maybe the endless token unlocks won't suppress the price. And maybe, just maybe, this time it’s different...

But probably not.

It's a Casino, and the House Always Wins

Let's cut the crap. This isn't an investment in the future of artificial intelligence. It's a gamble. You're not buying a piece of a revolutionary technology; you're placing a bet at a rigged roulette table. The meteoric rise of COAI is a textbook example of crypto hype-cycle mechanics, amplified by a hot narrative and questionable tokenomics. If you want to throw some money at it for fun, go ahead. But don't you dare call it an investment. When this house of cards comes tumbling down, don't say I didn't warn you.

Tags: ChainOpera AI