The Great Recalibration: We're Witnessing the Birth of a New Financial Mainstream

When I was at MIT, we used to have these late-night sessions fueled by bad coffee and wild ideas, sketching out what a truly digital, decentralized future might look like. We talked about programmable money, transparent ledgers, and a financial system built on code instead of closed-door agreements. For years, that's what it felt like—a brilliant idea, a blueprint on a whiteboard. But looking at the data flooding my screens this week, I honestly just sat back in my chair, speechless. The blueprints are becoming a skyline, right before our eyes.

We're not just watching another crypto bull run. This is different. This is the sound of Wall Street’s deepest vaults creaking open. When a single financial product, BlackRock’s iShares Bitcoin Trust (IBIT), pulls in over $790 million in a single day, that isn't retail speculation. That's a seismic shift. The total inflow of nearly a billion dollars into spot Bitcoin ETFs in one session isn't a signal; it's a declaration, with the Bitcoin Price Nears All-Time High with $985M ETF Inflows. The institutional gatekeepers have not only arrived at the party, they're now running the DJ booth.

For years, the argument against Bitcoin was its volatility, its lack of a physical anchor. But what we're seeing now is a complete reframing. Analysts at giants like Citi aren't just throwing out wild guesses; they're issuing formal 12-month price targets of $181,000 for BTC. They see what's happening: in a world of uncertainty, Bitcoin is becoming the premier digital safe-haven asset, a digital gold for the 21st century.

This institutional embrace is like building a multi-lane superhighway directly from the heart of the traditional financial world to the Bitcoin network. Before, access was a winding, complicated dirt road for enthusiasts and early adopters. Now, the largest pools of capital on Earth can allocate funds with the click of a button. This changes everything. But is this just about making one asset more valuable, or is it the first step in rewiring the entire concept of a corporate treasury?

The Twin Engine of a Digital Economy

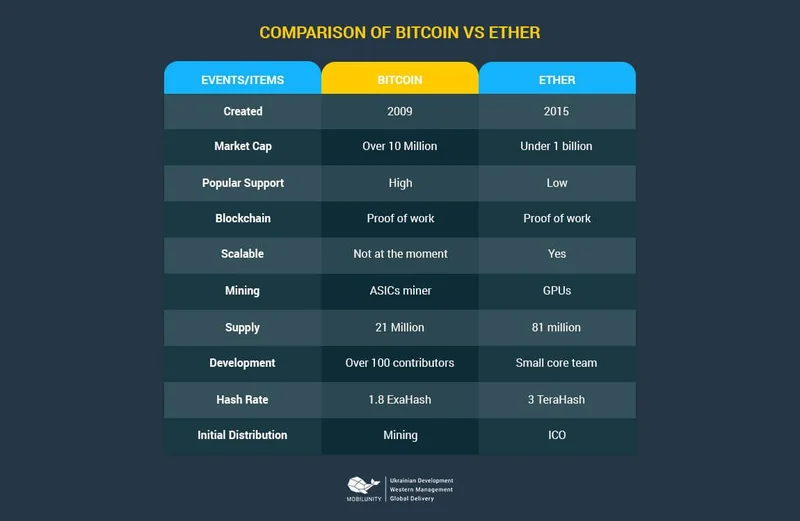

While Bitcoin solidifies its role as the system's pristine collateral, its digital bedrock, something equally profound is happening in the world of Ethereum. This isn't a competition; it's the emergence of a symbiotic relationship, a twin-engine system powering our digital future. If Bitcoin is the gold, Ethereum is the bustling metropolis being built on top of that gold standard.

Look at the quiet revolution happening with Digital Asset Treasuries, or DATs. This is a concept that needs a bit of a clarifying self-correction to grasp its full weight. A DAT is essentially a corporate treasury that lives on the blockchain—think of it as a company's primary bank account, but instead of just holding dollars in an opaque bank system, it holds programmable digital assets like ETH on a transparent, global ledger. Companies like BitMine Immersion Technologies now hold over 2.6 million ETH, worth a staggering $11.7 billion. That's not an investment; that's infrastructure. They are building their financial foundations on the Ethereum network.

This is why Citi bumped its year-end ethereum stock price target and is forecasting a rise to $5,440. They see the surge in interest driven by tokenization and stablecoin regulation. They understand that every time a real-world asset is tokenized, every time a new decentralized application is built, it requires Ethereum as its foundational layer. The on-chain data confirms this story beautifully. The amount of ETH held on exchanges is at a multi-year low. People aren't holding it to sell; they're pulling it off exchanges to use it, to stake it, to build with it.

The speed of this dual adoption is just staggering—it means the gap between the theoretical future we used to dream about and the practical reality of today is closing faster than we can even process, fundamentally altering how companies manage assets and how we define value itself. This isn't just about ethereum price usd going up; it's about its utility exploding. It forces us to ask a bigger question: What happens when the world’s most innovative companies no longer rely on traditional banks for their core treasury functions?

This moment feels so much like the late 1990s. We had the base protocols of the internet, the quiet, technical foundations that few understood. Then, all at once, the first wave of true internet-native businesses like Amazon and Google emerged, and the world was never the same. Bitcoin and Ethereum are those base protocols. We are living through that Cambrian explosion right now. We see it in the ripple effect, as breakthrough platforms like Solana see their prices surge and projects like BNB hit new all-time highs. A rising tide of legitimacy is lifting all boats.

Of course, with this incredible power comes profound responsibility. As we build this new financial world, we have to consciously design it to be more open, fair, and transparent than the one it's replacing. We have the tools to build a system with fewer gatekeepers and more opportunity, and we can't afford to squander that chance by simply recreating the flaws of the old world.

The Blueprints Are Now a Skyline

The debate is over. The endless questions of "if" and "why" have been answered by a tidal wave of capital and utility. We're past the point of speculation and are now firmly in the age of integration. What we are witnessing isn't a bubble; it's the foundational recalibration of value, trust, and commerce for a digital-first century. We are no longer just looking at charts and dreaming about the future. We are watching them build it, block by block. And it is going to be magnificent.

Tags: ethereum price