The US Treasury has officially stepped into the Argentine arena, purchasing an undisclosed quantity of pesos and finalizing a $20 billion currency swap line. The stated goal is to stabilize a spiraling currency crisis in a key South American economy. Treasury Secretary Scott Bessent, in a carefully worded statement, framed the intervention as a matter of "systemic importance" and a move to protect the "strategic interest of the United States."

On the surface, the market reaction was predictable. Argentine sovereign debt rallied and the peso found a temporary floor. But peel back the layer of diplomatic language, and the picture becomes substantially more complex. This isn't a simple act of hemispheric goodwill. This is a high-stakes financial maneuver, executed by a man who built his career on exactly these kinds of seismic currency plays. The political noise in Washington—with senators like Elizabeth Warren rightly questioning the use of US dollars abroad amidst domestic budget fights—is a distraction from the core of the operation.

The real questions aren't about the politics. They're about the numbers. What are the terms of this $20 billion swap line? What is the strike price, the duration, the collateral? The Treasury Department has been notably silent on these specifics. We are being asked to trust the judgment of the executive branch on a massive, leveraged bet on a notoriously volatile economy, all while being denied access to the prospectus.

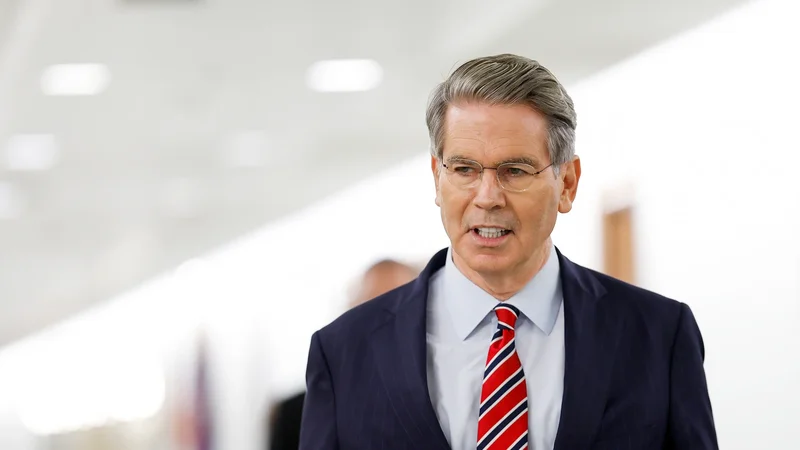

The Bessent Doctrine: Trader as Statesman

To understand this move, you have to understand Scott Bessent. His name is etched into financial history for his role in the "Black Wednesday" trade that broke the Bank of England in 1992. He isn't a career diplomat or a tenured economist; he is a trader who views the world as a complex system of assets, liabilities, and price dislocations. When he says the Argentine peso is "undervalued," as he did on Fox News, he isn't making a political statement. He's revealing his thesis.

This is the part of the entire affair that I find genuinely puzzling. Bessent is essentially front-running the market with taxpayer funds. He is making a call that President Javier Milei’s "reform agenda" will succeed, creating the conditions for the peso to appreciate. The US Treasury isn’t just providing a safety net; it’s taking a long position on Argentina. This is less like the IMF providing a structured loan and more like a hedge fund taking a large, activist stake in a distressed company. The currency swap line (valued at $20bn, or roughly £15bn) isn't a gift; it's the leverage. It allows Argentina to defend the peso using dollars, effectively letting the US Treasury dictate the terms of engagement against currency speculators.

But what model is Bessent using to determine the peso is "undervalued"? Is he looking at a purchasing power parity model, which is notoriously unreliable for emerging markets? Is it based on anticipated capital flows if Milei’s reforms stick? We don’t know. The silence on the methodology is deafening. A private fund would have to disclose its strategy to its limited partners. Here, the partners are the American public, and the strategy is a black box. What happens if Milei’s political capital evaporates after the midterm elections on October 26? What if his recent provincial election losses weren't an anomaly, but a leading indicator?

A Geopolitical Carry Trade with Unpriced Risk

Think of this operation as a massive geopolitical carry trade. The US is borrowing at its own low rates (in the form of political capital and financial risk) to go long an asset—a stable, US-allied Argentina—that it believes will yield a high return. The "return" isn't just a potential profit on the peso purchase, but the strategic value of a "prosperous Western Hemisphere," as Bessent put it.

The problem is the risk side of the ledger remains unpriced because it is undisclosed. Argentina is burning through its foreign reserves just to keep the lights on, with billions in debt payments coming due. The country’s financial history is a graveyard of nine sovereign defaults. The peso's value hasn't just declined; it has collapsed. In the last year alone, it lost about 50% of its value—to be more exact, a quick check shows the ARS/USD is down closer to 53.8% from its peak. To suggest this trend will reverse based on the sheer force of a US endorsement seems… optimistic.

This isn't a critique of Milei's agenda. It's a critique of the opacity of the intervention. A "strong, stable Argentina" may well be in the US interest. But is a $20 billion speculative play, with terms known only to a handful of people in the Treasury, the most prudent way to achieve it? It feels less like a calculated policy and more like a conviction trade, one that a hedge fund manager makes when they believe they have an informational edge the rest of the market lacks. The question is, what is that edge? Does Bessent know something about Milei's resolve, or Argentina's true reserve levels, that isn't public information? Or is he simply betting that the full faith and credit of the US Treasury is enough to scare the bears away?

That’s a bold bet. The market has a long and bloody history of calling the bluffs of even the most powerful central banks.

This Is a Trade, Not a Rescue

Let's call this what it is. The term "financial rescue" is a misnomer designed for public consumption. This is a speculative investment in a distressed sovereign nation, using the US balance sheet as collateral. There’s a fundamental difference between a bailout, which aims to prevent contagion with no expectation of a direct financial return, and what’s happening here. This move has a clear thesis: buy the peso low, provide dollar liquidity to force a short squeeze, and bet that a political ally can overhaul his economy before the market’s patience runs out. If it works, Bessent looks like a genius, and the US secures a key ideological and economic partner. If it fails, the $20 billion swap line becomes a very real liability, and the Treasury will be left holding a bag of rapidly depreciating pesos. The official narrative from the US kicks off controversial financial rescue plan for Argentina is one of stability; the underlying mechanics are those of a high-risk, high-reward currency trade.

Tags: scott bessent