Let’s get one thing straight. Every time I see a Wall Street consensus rating like "Moderate Buy" slapped on a behemoth like Verizon, my cynical alarms don't just go off—they scream. It’s the financial equivalent of a shrug. It’s the blandest, most non-committal piece of advice you can give, perfectly designed to sound positive while meaning absolutely nothing. And for a stock like Verizon ($VZ), it’s a trap, pure and simple.

The data says analysts are split: three "Strong Buys," six "Buys," and a whopping eleven "Holds." You call that a "Moderate Buy"? I call that a room full of well-paid people who have no damn clue what this stock is going to do next, so they're hedging their bets to avoid looking stupid later. It’s a classic case of covering your ass. They boost price targets by a buck or two—wow, Morgan Stanley, from $47 to $48, don't break the bank—and call it analysis.

And the retail investor, the average person trying to make their money work for them, sees "Buy" and thinks it's a green light. It's not. It's a yellow light on a rusty traffic pole that’s been flickering for a decade.

The Dividend Is the Cheese in the Mousetrap

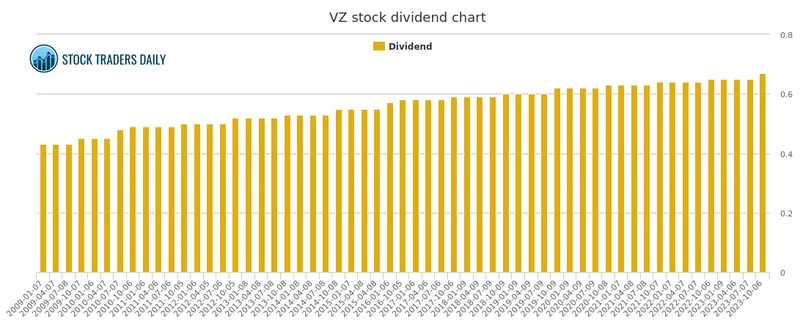

Okay, let's talk about the only thing anyone ever wants to talk about with Verizon: the dividend. They just bumped it up again, to $0.69 a share. That works out to a juicy 6.9% yield. Looks great on paper, doesn't it? It's the financial comfort food for a portfolio. A reliable check in the mail.

But here’s the reality: that dividend is the only thing keeping this stock afloat. It’s the shiny lure dangled in front of your face to distract you from the fact that the stock itself is a lumbering, debt-saddled giant that moves with the grace of a tranquilized elephant. Look at the 52-week range: $37.58 to $47.35. We’re talking about a stock that’s basically been treading water, stuck in the mud while actual tech companies are launching rockets. Buying Verizon for capital appreciation is like buying a savings bond and expecting venture capital returns. It ain't happening.

This isn't an investment; it's a holding pattern. The company is basically a utility at this point. No, 'utility' is too exciting—it's a bond that thinks it's a stock. That massive 1.19 debt-to-equity ratio isn't just a number on a spreadsheet; it's an anchor. What happens to that "safe" dividend when interest rates stay high or the next recession finally hits and that debt becomes a real problem? Are we supposed to believe that a 5.2% year-over-year revenue increase is some kind of triumph? For a company this size, that's barely keeping the lights on.

And who is buying this story? Institutional investors, apparently. 62% of the stock is owned by the big boys. But even they seem conflicted. A recent filing shows Johnson Investment Counsel Inc. Sells 7,024 Shares of Verizon Communications Inc. $VZ. It’s not a huge amount, but it’s a signal. The smart money is trimming, while they tell you it’s a "Moderate Buy." It feels like they're the ones selling while telling you to hold the bag. I mean, they have to sell to someone, right?

Wall Street's Convenient Amnesia

The most telling piece of information isn’t even in the main report. It’s the little kicker at the end from MarketBeat: "MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now... and Verizon Communications wasn't on the list."

Read that again. The real recommendations, the ones they're "quietly whispering" to their high-value clients, don't include this dog. The "Moderate Buy" is for public consumption. It's the polite, generic advice they can print without getting into trouble. The real action is happening somewhere else. It makes you wonder what else they're not telling us...

This whole charade is a perfect example of how the game is played. They beat earnings by three cents—congratulations, you successfully managed expectations downward enough to step over a very low bar. They raise the dividend by a penny. The stock price bumps around in the same channel it’s been in for years. And the analysts, offcourse, call it a win.

Maybe I'm the one who's crazy. Maybe a stagnant stock with a high dividend is exactly what some people want. But don't call it a growth opportunity. Don't call it a "Moderate Buy" as if it has exciting upside potential. Call it what it is: a place to park your cash and pray the dividend checks don't stop coming. It's a bet on inertia, not innovation. And in today's market, betting on inertia is one of the riskiest bets you can make.

Just a Utility Bill in Disguise

Let's be brutally honest. Buying Verizon stock right now isn't an investment strategy; it's an admission of defeat. You're not buying a piece of the future; you're buying a glorified, high-yield savings account with market risk. That 6.9% dividend isn't a reward; it's compensation for the soul-crushing boredom and lack of growth you're signing up for. Wall Street can call it a "Moderate Buy," but I'll call it what it is: a trap for people who have given up on finding actual value.

Tags: vz stock