Let's get one thing straight. Every time I see a headline like Where Will Uber Stock Be in 5 Years?, my eyes glaze over. It's the financial equivalent of asking what the weather will be like next Tuesday. Sure, you can look at the models, but you and I both know it's a crapshoot. The company is a household name, a verb even. "Just Uber it." We get it. They've wedged themselves into the cultural lexicon.

But being a verb doesn't make you a sound investment. Just ask Xerox.

The bull case is so boringly predictable it could be generated by an AI. They point to 180 million users, a "network effect," and a 174% stock surge over five years. Great. Fantastic. You can almost hear the slide click to the next bullet point in the investor presentation. They talk about "disruptive DNA" like it’s some magical elixir. What did they disrupt? The taxi industry, sure. But also labor laws, city traffic, and the idea of a stable wage. And now, after all that disruption, the stock's down 8% from its peak and the options market is flashing warning signs.

This is where the neat, tidy narrative starts to fall apart.

The Shiny Surface vs. The Grimy Underbelly

Wall Street loves to sell you on the story. With Uber, the story is about an unstoppable platform, a data-hoarding behemoth that's now even selling ads. They're generating $1.5 billion in ad sales. Wonderful. They're monetizing our desperation for a ride home from the bar. It’s the American dream.

But peel back one layer of that onion and it stinks. Uber’s entire existence is predicated on a future it doesn’t control. The real revolution isn't ride-hailing; it's autonomy. And who's leading that charge? Not Uber. It's Tesla stock with its robotaxi ambitions. It's Alphabet's Waymo, which is part of the Google stock empire. These are the companies building the brains. The real game-changer is the self-driving car, powered by chips from companies like Nvidia stock or AMD stock.

Uber’s grand strategy? "Partnerships."

Let me translate that for you. "Partnerships" is corporate-speak for "We're desperately hoping the people building the actual future will let us use their tech so we can remain relevant." Uber is like a DJ who doesn't make any music but has a massive list of contacts. It's a powerful position, for now. But what happens when the artists—the Teslas and Waymos of the world—decide to throw their own parties? What's stopping them from building their own app and cutting out the middleman? Uber's "moat" looks less like a fortress and more like a puddle. The idea that Uber is some untouchable monolith is just... well, it's a nice story for a PowerPoint deck.

The Casino Floor of "Quant Signals"

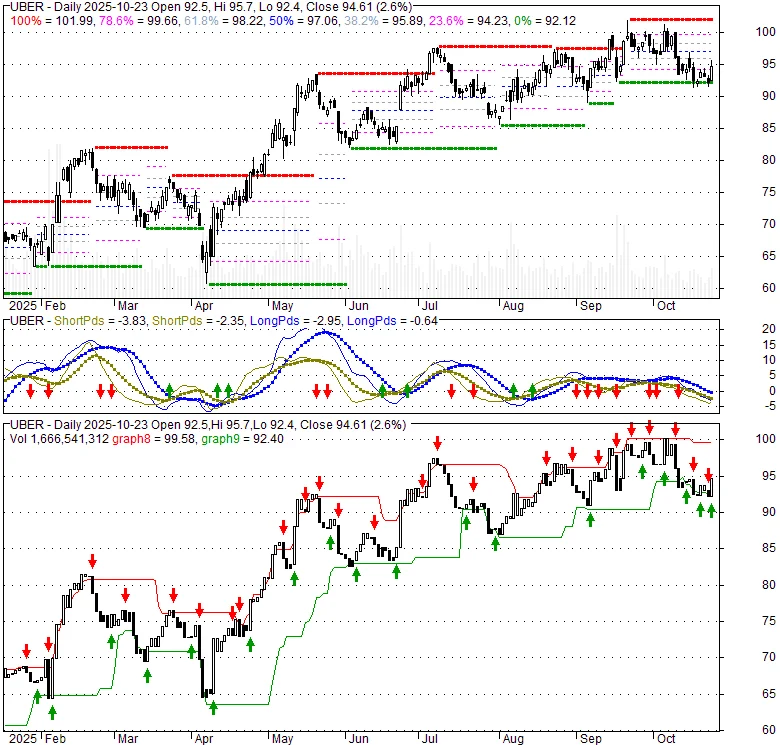

Just when you think the conversation can't get any more detached from reality, you stumble into the weird, cult-like world of quantitative analysis. There’s this new theory floating around—one that claims UBER Stock is an Unusual Options Candidate But It’s the Quant Signal That’s the Star—that uses marine biology—I kid you not, sharks—as an analogy for market patterns. The argument is that you can "tag" stock price movements like you tag a Great White and predict where it's going next.

This sounds like voodoo. No, "voodoo" is too mystical—this is just high-stakes pattern matching dressed up in a lab coat.

Apparently, UBER stock has flashed a rare "4-6-U" signal. Four up weeks, six down weeks, but an overall upward trend. This sequence is so rare it only happens about 3.5% of the time. And when it does, it supposedly has a 72.7% chance of leading to a price jump. They're even laying out specific options trades, like a bull call spread targeting $100.

It’s like a professional card counter at a blackjack table. They’ve studied the probabilities, they know the patterns, and they’re betting on a statistical edge. But here's the thing about card counting: it works right up until the casino manager throws you out or, more aptly, the entire game gets upended. This quant signal doesn't account for a sudden DOJ investigation, a massive driver strike, or TSLA suddenly announcing its robotaxi fleet is live in 50 cities. It's a mathematical abstraction in a world governed by messy, unpredictable human behavior. Offcourse, some people will make a fortune on it. But many more will get wiped out chasing the signal.

Are we supposed to ignore the fact that the big money, the "smart money" in the options flow, is overwhelmingly bearish? Are a few quants with a shark-tagging algorithm smarter than the entire market? Maybe. Or maybe they’re just the last ones to realize the party's over. Chasing these signals feels less like investing and more like betting on a horse because you like its name. Everyone is looking for the next NVDA stock price rocket, but most of what they find are duds.

So, We're Betting on Sharks Now?

Here’s the unfiltered truth. Uber is a fantastic service. I use it. You probably use it. But the stock is a completely different beast. It's a bet that a middleman can retain its power even as the technology that underpins its entire industry is being reinvented by its competitors. It’s a bet that a clever algorithm can predict the future better than the institutional players who are actively shorting it.

The whole thing feels fragile. The optimistic five-year projections and the weird quant signals are just two different flavors of hope. One is based on a corporate narrative, the other on a statistical anomaly. Neither feels grounded in the brutal reality that Uber doesn't actually make the cars, write the AI software, or manufacture the chips. They just have the app. And in the tech world, an app is the most replaceable part of the entire equation.

I don't know where Uber will be in five years, and anyone who tells you they do is selling something. But I know this: it ain't the sure thing Wall Street wants you to believe it is.

Tags: uber stock