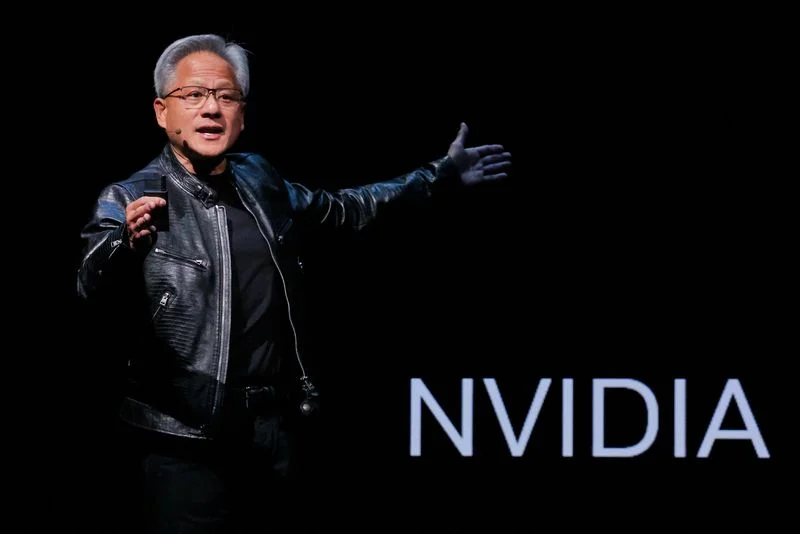

Alright, let's get one thing straight: everyone's losing their minds over TSMC's big Arizona expansion. Six fabs, $165 billion, blah, blah, blah. Nvidia's riding high, stock's up 1,390%—give me a break. But before we start popping champagne corks and chanting "USA! USA!", maybe we should pump the breaks for a hot minute.

The Hype Train is Leaving the Station

TSMC is planning to mass-produce 2nm chips this year. This year! And C.C. Wei is promising more investment in Taiwan and accelerated expansion in the US. Sounds great on paper, right? Like we’re suddenly gonna become a chip-making powerhouse overnight thanks to the CHIPS Act.

But here's the thing: promises are cheap. Especially when billions of dollars are involved. We've seen this movie before, haven't we? Remember all those "shovel-ready" infrastructure projects? How'd that work out?

And Wall Street's all in, revenue estimates are climbing, Nvidia's stock is through the roof. Yeah, well, Wall Street also thought Pets.com was a good idea. So maybe, just maybe, their enthusiasm isn't the best indicator of future success.

I mean, seriously, $10,000 invested in Nvidia in October 2022 is now worth almost $150,000? That's insane. It's not investing, it's gambling. And like all bubbles, this one's gonna pop eventually. Some analysts believe other stocks may outperform Nvidia in the coming years, as discussed in Is This the Only Stock That Will Outperform Nvidia for the Next 3 Years? - The Motley Fool.

The Reality Check

Let's talk about the actual chips for a second. TSMC produced almost 12,000 different products in 2024. That's a staggering amount of complexity. And 60% of their revenue comes from the most advanced stuff, the 3nm and 5nm chips. So, Arizona’s gonna be pumping out the good stuff, right? Or are we gonna be stuck making the chips nobody else wants?

And what about talent? Are there enough skilled workers in Arizona to run six fabs? Because last time I checked, building semiconductors ain't exactly like flipping burgers. This isn't Field of Dreams; just because you build it doesn't mean the engineers will come.

Offcourse, the CHIPS Act is supposed to help with that too, right? More money for training, more incentives for companies to build here. But let's be real, government programs ain't exactly known for their efficiency. I'm sure there are going to be some cost overruns...

TSMC expects Q4 revenue to be between $32.2 billion and $33.4 billion. That's a lot of money. But their operating margin is only "about" 50%? For a company that basically owns the semiconductor fabrication market (70% market share, people!), that seems... low. What are they spending all that money on?

The Taiwan Question

And let's not forget the elephant in the room: Taiwan. TSMC is a Taiwanese company. And Taiwan's relationship with China is, shall we say, complicated. C.C. Wei can say all he wants about investing in both Taiwan and the US, but let's not pretend there isn't a geopolitical risk here.

What happens if China decides to "reunify" with Taiwan? Suddenly, our shiny new Arizona fabs don't look so shiny anymore. We're putting all our eggs in one basket... or rather, all our silicon in one potentially unstable island.

Then again, maybe I'm the crazy one here. Maybe this is all gonna work out perfectly. Maybe Arizona will become the new Silicon Valley, and America will reclaim its chip-making crown. Maybe pigs will fly.

This is Gonna End in Tears

I'm calling it now: this whole TSMC Arizona thing is a house of cards built on hype and wishful thinking. We're so desperate to believe in a manufacturing renaissance that we're ignoring all the warning signs. So, what's the real story? A few people are going to get incredibly rich, and the rest of us are going to be left holding the bag when the bubble bursts.

Tags: nvidia news today