Super Micro's Rocket Ride to the Moon is Fueled by AI Hype and Accounting Nightmares

Let’s get one thing straight. Super Micro Computer (SMCI) just had a great day. The stock popped nearly 10 percent, blasting past fifty bucks a share like it was nothing. The day traders and the AI-true-believers are probably high-fiving each other over their oat milk lattes. They’re looking at the 45 million shares that changed hands and seeing "renewed investor confidence."

I look at it and I see a fever dream.

This isn’t a comeback story. This is the part in the horror movie where the kids think the monster is dead, so they start celebrating right before the final jump scare. Because underneath the hood of this AI darling, the engine is rattling, smoke is pouring out, and the chief mechanic just parachuted out the emergency exit.

Wall Street's Favorite Story Has a Plot Hole

The AI Sugar High

You can’t deny the top line. It’s insane. Super Micro is selling the picks and shovels in the biggest gold rush since, well, actual gold. The whole world has gone nuts for artificial intelligence, and that means they need servers. Mountains of them. Racks and racks of humming, liquid-cooled boxes packed with the latest and greatest silicon from NVIDIA. And SMCI is Johnny-on-the-spot, cranking out these `ai stock`-powering machines as fast as they can.

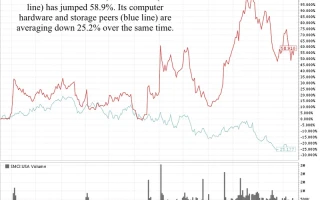

Their revenue shot up from $15 billion to nearly $22 billion in a year. They’re forecasting it’ll hit $33 billion next year. Numbers like that make Wall Street analysts drool. They see that tight relationship with `nvda` and their ability to ship the newest, hottest GPUs first, and they start throwing around "Buy" ratings like confetti at a parade.

They call it being a "Total IT Solutions" provider. I call it being a really, really good box assembler. They take parts from Intel, `amd stock`, and NVIDIA, slap them into a chassis with their "Building Block" design, and ship 'em out. It's a great business to be in when everyone from hyperscalers to your cousin’s tech startup needs a GPU server. It’s the ultimate story stock, the kind of thing that makes you feel like you’re investing in the future.

But when the auditor quits…

The Five-Alarm Fire Burning Under the Revenue Chart

But the Hangover is Coming

This is the part of the story the cheerleaders don't want to talk about. While the revenue chart is going vertical, the profit margin is shrinking. It’s down to a razor-thin 4.77%. For the fiscal year, they pulled in a billion in net income on $22 billion in sales. This is just bad business. No, 'bad' isn't the word—it’s a kamikaze mission with spreadsheets. They're selling more stuff than ever but making less on each sale. How is that a winning long-term strategy? It ain't.

It reminds me of the dot-com days, where companies were celebrated for "eyeballs" and "growth" while they burned through cash like it was scrap paper. It’s all about the narrative, the hype. It’s why people are still gambling on `pltr` and treating `tsla stock` like a religion instead of a car company with panel gaps.

Then there’s the fun stuff. The really fun stuff.

Last year, the short-seller Hindenburg Research—you know, the folks who enjoy poking holes in bloated company narratives—put out a report alleging accounting shenanigans. Shortly after, the U.S. Department of Justice and the SEC started sniffing around, issuing subpoenas. And then, in the single biggest red flag a company can possibly wave, their auditor, Ernst & Young, resigned.

Let me translate that for you. Auditors don't just "resign." They are paid huge sums of money to sign off on the books. When they walk away, citing "significant concerns" over internal controls and board independence, it’s the corporate equivalent of a five-alarm fire. And offcourse, the company says an internal probe found no evidence of fraud. What else are they going to say?

I swear, all these tech companies are reading from the same terrible PR script. It's all "synergy" and "leveraging platforms" and "we take these allegations seriously." Give me a break.

And while all this is happening, the insiders are cashing out. The CEO, Charles Liang, and other directors have sold off hundreds of thousands of shares, pocketing millions. Nothing says "I have total faith in the long-term prospects of this company" like dumping your stock while telling everyone else to buy.

The stock did a 10-for-1 split to make the shares cheaper and more attractive to retail investors. It’s a classic move. When the story starts to fray, you make it easier for the little guy to buy in and hold the bag.

Then again, maybe I'm the crazy one here. The `smci stock price` is up. The revenue is exploding. The AI revolution is real. Maybe this is just what hyper-growth looks like: messy, chaotic, and a little bit terrifying. Maybe the rules don't apply when you’re building the backbone of the next technological age.

Or maybe, just maybe, it’s a house of cards built on a foundation of hype, powered by cheap debt and questionable accounting. And this recent 10% pop is just the wind picking up before the whole thing comes tumbling down.

It's a Casino, Not a Company

Look, I'm not a financial advisor, and this sure as hell isn't advice. But what I see in Super Micro isn't an investment. It's a bet. You're betting that the insatiable, manic demand for AI servers will be so massive that it papers over every single crack in this company's foundation. You're betting that the shrinking margins don't matter, the insider selling is just prudent financial planning, and the auditor quitting was just a big misunderstanding. It’s a bet on the story, not the business. And in my experience, the story is always the first thing to fall apart.

Reference article source:

- SMCI Stock Soars After Rebound: What Investors Need to Know in October 2025

- Super Micro Computer, Inc. (SMCI): Powering the AI Revolution with Purpose

Tags: smci stock