The Tremors of a New Era: Why Super Micro’s Wild Ride Is a Barometer for the Future

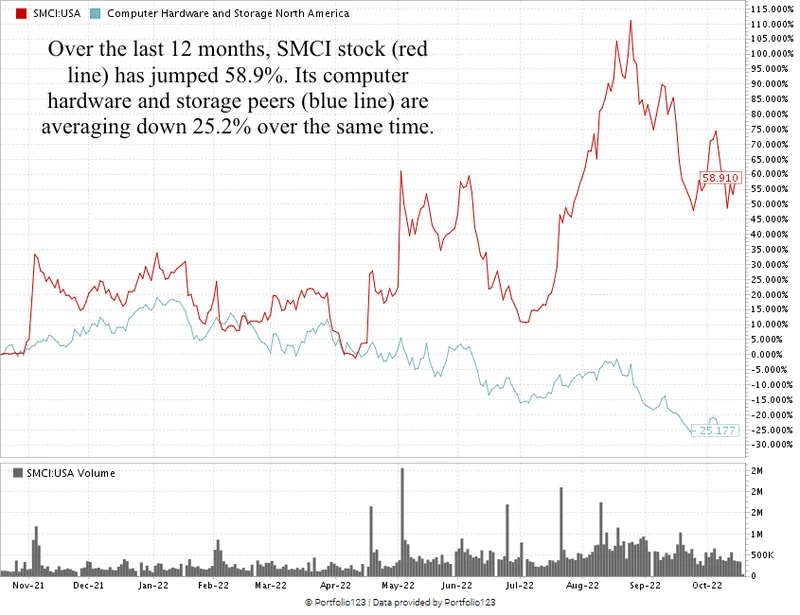

If you looked at a stock chart for Super Micro Computer (SMCI) this week, you might feel a bit of whiplash. On October 1st, the `smci stock price` rocketed up nearly 10%, closing at $52.39 on a massive surge of trading volume. It felt electric. But this wasn’t a breakout into blue skies; it was a rebound from a brutal summer sell-off, a climb back from the depths of doubt sparked by a minor earnings miss and a scathing short-seller report.

On the surface, the story is messy. Conflicting. Analysts have a consensus price target of $47.47, implying the stock is overvalued right now, even after its heroic climb. Insiders, including CEO Charles Liang, have been selling shares. The company is under investigation by the DOJ. If you just read the headlines, you’d be forgiven for thinking this is just another volatile tech stock, a risky bet in a sea of uncertainty.

But I believe that’s the wrong way to look at it. I believe we’re not seeing the chaotic spasms of a troubled company. We are feeling the first seismic tremors of a new industrial revolution, and SMCI is sitting right on the fault line.

To understand what’s really happening, you have to look past the ticker and see what Super Micro actually builds. They don’t create the glamorous AI models or the headline-grabbing software. They build the house that AI lives in. They manufacture the high-performance, GPU-accelerated servers—in simpler terms, the super-powered computers that are the physical engine of artificial intelligence. When you ask an AI to write a poem or design a molecule, your request is being processed on racks and racks of hardware exactly like the kind SMCI designs, builds, and ships at a breathtaking pace.

This isn't just about adding more computers to a data center. We are in the middle of a paradigm shift in computation, a pivot so fundamental that the demand for this specific type of hardware is nearly insatiable. Companies like NVIDIA, with its world-changing `nvda stock`, and AMD are designing the silicon brains, but it's companies like Super Micro that are building the powerful bodies those brains need to function. They are the architects of the physical infrastructure that will support the next century of innovation. The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend, and it all runs on hardware.

This is the kind of breakthrough that reminds me why I got into this field in the first place. Super Micro’s “Building Block” system isn't just clever engineering; it’s a philosophical approach. It allows customers to create bespoke systems, perfectly tuned for their needs, which accelerates deployment and innovation for everyone.

Think about the California Gold Rush. Sure, a few prospectors struck it rich. But who consistently made a fortune? The people selling the picks, the shovels, and the blue jeans. Or consider the dawn of the railroad age. The real, foundational wealth was built not just by the railroad barons, but by the companies that forged the steel rails and built the locomotives. That is the role Super Micro plays today. It’s a foundational enterprise, providing the essential tools for the `ai stock` boom.

Why Market Chaos is the Sound of a Revolution

The Signal Inside the Noise

So, what about all that fear and uncertainty? The Hindenburg report, the insider selling, the earnings miss that sent the stock tumbling below $45? I see it not as a red flag, but as a stress test. The market panicked, as it often does. It focused on a quarterly miss of a few cents per share while ignoring the fact that the company’s revenue is projected to explode from nearly $22 billion to over $33 billion next year. That isn’t growth; that’s a shockwave.

The volatility we see, that dizzying beta of 2.75, isn’t a sign of instability in the company itself. It’s a sign of the market’s profound inability to price a revolution in real-time. How do you build a discounted cash flow model for the dawn of general intelligence? How do you calculate the P/E ratio for the machinery that will redefine every industry on Earth? You can’t. You get what we’re seeing now: fear and greed battling it out, creating waves of volatility that look like chaos but are, in fact, the signature of profound transformation. It’s the same dynamic that has defined visionary companies from `tsla` to `nvda`.

Of course, with this kind of power comes immense responsibility. As we build these digital cathedrals, we have to be relentlessly thoughtful about what we are enshrining within them. The infrastructure SMCI is creating will be used for incredible medical breakthroughs, for solving climate change, for educating the world. It will also be used in ways we can’t yet predict, and we must be the vigilant, ethical guardians of this new power.

But the fear is a distraction from the fundamental truth. While Wall Street obsesses over decimal points, a global build-out of unprecedented scale is underway. I’ve seen chatter online from engineers—the people actually building this future—and they aren't talking about quarterly earnings. They’re talking about lead times for NVIDIA’s new GB300 chips and the genius of Super Micro’s direct liquid cooling systems. They see the reality on the ground: the demand is real, it's massive, and it's just getting started.

So when you see the `smci stock price` jump 10% in a day, don't just see a number on a screen. See the signal. It’s the sound of another thousand servers humming to life, another rack being slotted into place, another brick being laid in the foundation of our collective future.

The Blueprint for a New Age

Forget the stock charts for a moment. We are witnessing the construction of the most important infrastructure of the 21st century. The noise, the volatility, the fear—it is all secondary to the tectonic shift happening beneath our feet. This isn't about one company's balance sheet. It is about pricing the un-priceable: the physical architecture of tomorrow's intelligence. And right now, the blueprints are being drawn up in real-time.

Reference article source:

- SMCI Stock Soars After Rebound: What Investors Need to Know in October 2025

- Will SMCI's Next-Generation Products Fuel Long-Term Growth?

- Why Is Super Micro Computer Stock Trending Tonight? - Intel (NASDAQ:INTC), HP (NYSE:HPQ)

Tags: smci stock