So, I’m scrolling through the latest crypto news feed, and I see a headline that almost makes me spit out my coffee. Sui Group Holdings, a Nasdaq-listed company, is launching its own stablecoins and wants to become a "next-generation SUI Bank."

A "next-generation bank." Give me a break.

Let's call this what it is: a publicly traded company has decided to print its own version of the dollar. This isn't some scrappy team of cypherpunks building a decentralized future. This is a corporation in a suit and tie looking at the Federal Reserve and saying, "Hey, we want in on that action." And they’re doing it with all the hollow, self-important jargon the crypto world loves to eat up.

The New Bosses, Same as the Old Bosses

Sui is partnering with Ethena to launch suiUSDe and USDi (SUI Stablecoins Launch via Ethena Partnership). One gives you yield, one doesn't. They claim this is about reducing dependence on Circle's USDC and creating "new financial options." Translation: they want to control the central pillar of their own ecosystem's liquidity. It's like a casino deciding to mint its own poker chips, except these chips are backed by a complex web of treasury holdings and partnership agreements that you, the user, are supposed to just trust.

The company's chairman, Marius Barnett, envisions creating a "liquidity hub for the entire ecosystem." It’s a beautiful, clean, corporate phrase. But what it really means is they want to be the tollbooth operator for every transaction on their network. They get to set the terms, control the flow, and, most importantly, rake in the revenue from the reserves.

And get this—the company has a "direct purchase agreement" with the Sui Foundation to buy SUI tokens at a discount. How cozy. They’re literally buying up their own ecosystem's currency on the cheap while simultaneously positioning themselves as its central bank. Does this sound like a level playing field to you? Or does it sound like an inside game designed to enrich shareholders under the guise of innovation? This is a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of conflicts of interest just waiting for a spark.

This whole setup is being sold as "groundbreaking corporate participation." It’s the ultimate magic trick: take the old, centralized banking model that crypto was supposed to destroy, slap a "Layer-1" sticker on it, and sell it back to people as the future. And the scariest part? People will probably buy it.

A System So Secure, It Only Leaks Millions

While the suits at Sui are busy building their digital fiefdom, the rest of the crypto landscape continues to be the Wild West. On one side of my screen, I’m reading about a "next-generation SUI Bank." On the other, I see that SBI Crypto, a subsidiary of a massive Japanese financial conglomerate, just got fleeced for $21 million (SBI Crypto Loses $21M in Suspected North Korean Hack).

The details are depressingly familiar. The funds—a cocktail of `BTC`, `ETH`, and other coins—were snatched and immediately flushed through Tornado Cash, the crypto world's favorite laundromat. The on-chain sleuth ZachXBT points the finger, and it lands on a familiar boogeyman: North Korean hackers, likely the Lazarus Group.

This ain't some kid in a hoodie guessing passwords. These are state-sponsored operations systematically draining exchanges. SBI Crypto is part of SBI Group, a financial titan. If they can’t keep their digital wallets locked down, what chance does the average person have? Every time I hear about "institutional adoption," I picture a scene like this: a boardroom full of executives getting a frantic call that their `bitcoin` holdings are now funding a rogue state's weapons program.

The industry’s response is always the same. They blame the mixers like Tornado Cash, and governments try to sanction the code. But that’s like blaming the getaway car instead of the bank robbers. The real problem is the ridiculously fragile security that underpins so much of this industry, and everyone knows it... They build these glass houses and then act shocked when a well-thrown rock shatters them. What’s the point of a "next-generation bank" if it has backdoors big enough for an entire nation-state to walk through?

It's all part of the same offcourse. One day you're reading the whitepaper for a new "decentralized AI operating system" like 0G, promising to revolutionize everything with a "modular architecture." The next day, you're looking at a Solana meme coin called TROLL that openly admits it has "no intrinsic value." It’s a spectrum of absurdity, from complex, jargon-laden promises to honest-to-god digital garbage. And all of it is vulnerable.

Am I just too jaded? Maybe I’m the old man yelling at a cloud, unable to appreciate the genius of on-chain AI or the community-building power of a troll-themed token. Then again, I've seen this movie a dozen times. The hype cycles, the hacks, the promises of a new financial paradigm. It just feels like noise.

Same Circus, Different Clowns

At the end of the day, none of this feels new. A corporation wants to be a bank. Thieves want to be rich. And a whole lot of people are gambling on digital tokens hoping to be one or the other. We've dressed it all up with fancy new technology and a vocabulary that would make a Silicon Valley VC blush, but the underlying human motivations are as old as dirt. It's a shiny, decentralized, blockchain-powered circus, but the acts are all the same. And we, the audience, are paying for the tickets.

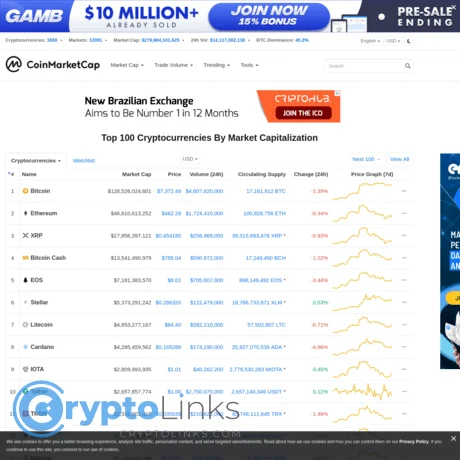

Tags: coinmarketcap