So, another press release landed in my inbox. This one, dripping with the kind of corporate buzzwords that make my teeth ache, announced that "CZR Exchange" is now officially listed on CoinMarketCap. The headline screams about a "New Era of Transparency and Global Reach."

Give me a break.

Every time one of these things shows up, I can practically smell the cheap suits and stale coffee from the marketing meeting where it was born. "Transparency," they say. "Innovation." "Borderless." These words have been stripped of all meaning, beaten into a fine powder, and sprinkled over every half-baked crypto project that crawls out of the digital primordial ooze.

Let's look at the facts, shall we? CZR Exchange, founded by a guy named Charlie Rothkopf, is headquartered in the Cayman Islands. Its holding company is in the BVI. I’m sure that’s just a coincidence. Nothing says "transparency" quite like nesting your company in the world’s most notorious tax havens. It’s like a vegan restaurant proudly announcing its new partnership with a slaughterhouse. The message is, to put it mildly, a little mixed.

Rothkopf says in the official press release, CZR Exchange Officially Listed on CoinMarketCap, Marking a New Era of Transparency and Global Reach, “CoinMarketCap’s recognition is more than a listing—it’s validation of our mission to deliver fair, borderless access to digital assets.”

Here’s my translation: "We paid the fee and checked the boxes, so now we have a shiny logo on a popular website that will hopefully trick some retail investors into thinking we're the next `Coinbase`." What exactly is this "fair, borderless access"? Does it mean they've solved the regulatory nightmare that is global finance, or does it just mean their website works in more than one country? My money is on the latter.

Another Brick in the Wall

CZR Exchange boasts a "high-performance trading experience" and an "intuitive dark-mode interface." Groundbreaking. They also support trading for `BTC`, `ETH`, and all the other usual suspects. It’s offcourse a solid list, but it’s the same list you’ll find on a hundred other exchanges.

This is the core of the problem. In a space that screams about decentralization and breaking the mold, everyone seems to be building the exact same thing. A new `crypto` exchange today is like a new MySpace page in 2012. You’re a little late to the party, the cool kids have already left, and the whole place smells kinda funny. What is the actual, tangible innovation here that justifies its existence against giants like `Binance` or Kraken? Is a "forthcoming crypto debit card" really the killer app we've all been waiting for?

The whole operation spans Europe, Africa, and Latin America. But what does that even mean? Is there a bustling CZR office in Nairobi, or is it a single freelance contractor working from a WeWork? The details are, as always, conveniently vague. They're "pursuing" top-tier licenses and "developing" regional liquidity. That’s a whole lot of future-tense for a company announcing its grand arrival.

It’s all just a blueprint. A copy of a copy. They've seen what works for other exchanges and they're just... doing that. And maybe that's fine. Maybe there's a market for the crypto equivalent of a generic-brand soda. But don't you dare call it a "new era." It's the same era, with a different font. Honestly, I'm not even mad. I'm just bored.

The Billion-Dollar Ghost in the Machine

If CZR is the symptom, then something like Monad is the disease in its full-blown, fever-dream stage. Monad, a new layer-1 blockchain, announced its airdrop is coming. The claims portal opens October 14. Great. The catch? Nobody knows who is eligible, how many tokens they’ll get, or what the vesting schedule looks like.

Despite a complete lack of concrete information, the market has already spoken. Traders on the decentralized exchange Hyperliquid are already betting on the future price of the non-existent $MON token. Based on this pre-launch gambling, Monad has a fully diluted valuation of around $12 billion, according to a CoinMarketCap report titled Monad Airdrop Portal Opens Oct. 14 With $12B Valuation.

Let that sink in. Twelve. Billion. Dollars. For a project that hasn't even distributed its token to the public.

I picture some kid in a dark room, lit only by the glow of a `tradingview` chart, frantically clicking buttons to long a token that is, for all intents and purposes, a ghost. This isn't investing. This isn't even speculation. This is mainlining pure, uncut hype. The valuation isn't based on technology, or adoption, or revenue—it's based on a collective fantasy.

This is the part of the `crypto` world that makes my skin crawl. It’s a joke. No, a joke is supposed to be funny. This is just a cynical, high-stakes game of musical chairs where the venture capitalists and insiders know exactly when the music will stop, and everyone else is left scrambling for a seat that was never there. Why the secrecy around the airdrop details? Is it to build suspense, or is it to give insiders a chance to position themselves perfectly before the public gets the scraps?

Then again, maybe I'm the crazy one. Maybe a $12 billion valuation for a promise is the new normal, and I'm just an old man yelling at a cloud. They're printing money out of nothing, and we're all just supposed to clap along like seals...

At least some projects seem to be trying to solve an actual problem. I read about DoubleZero, a project built on the `solana coinmarketcap` ecosystem that's trying to create a low-latency network for validators. It’s a niche, technical problem, but it’s a real one. The public internet is congested and slow, and for high-frequency operations like block production, that’s a big deal. Chiliz is another one, building a dedicated chain for sports and entertainment fan tokens. Again, niche. Maybe even a little silly. But it's a defined purpose.

These projects aren't just building another generic casino. They're building plumbing. It's not sexy, and it probably won't get a breathless press release about a "new era," but it's work. Does that mean they'll succeed? Who knows. But it feels a hell of a lot more honest than launching another exchange with a dark mode and calling it a revolution.

Same Circus, Different Clowns

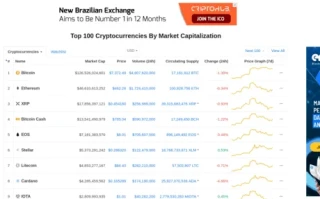

At the end of the day, a listing on `CoinMarketCap` doesn't mean a project is legitimate, innovative, or even useful. It just means it exists. It’s a digital birth certificate. CZR Exchange can wrap itself in the language of transparency and global access, but it's just another face in a very, very large crowd. The real story in `crypto` isn't about who gets listed on a price-tracking website. It's about the ever-widening chasm between projects building actual infrastructure and those building elaborate marketing funnels designed to capture retail exit liquidity. And right now, the funnel-builders are winning.

Tags: coinmarketcap