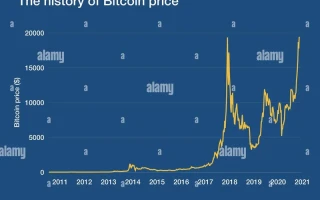

So, Bitcoin hit a new all-time high. A glorious, screen-shattering $124,688. I can almost picture the scene: tech bros in Patagonia vests high-fiving in slow motion, refreshing their Coinbase accounts until their thumbs bled. They did it. They finally beat the system.

For about 24 hours.

Then, like every crypto story ever told, the other shoe dropped: the Bitcoin rally loses steam as crypto prices slide. A little pullback to $122K. Nothing major, just a casual 2% haircut. A gentle reminder that the rocket ship you’re riding is fueled by little more than hype and institutional-grade FOMO.

And that’s the real story here, isn’t it? Not the price, which is a meaningless number pulled from the ether. It’s the narrative the big boys are spinning now that they’ve decided to join the party. They’ve looked at this weird internet money, realized they can’t kill it, and have moved on to the next best thing: taming it, packaging it, and selling it back to you with a fancy new label.

The "Unique Diversifier" Charade

The new buzzword, courtesy of the financial high priests at BlackRock, is that Bitcoin is a “unique diversifier.” Let me translate that for you from PR-speak into English: “We have no damn clue what this thing is, but it doesn’t move in lockstep with the stuff we do understand, so you should probably buy some. For a fee, offcourse.”

They’re trying to sell it as digital gold, an insurance policy against the inevitable implosion of fiat currency. They point to its performance during global crises, noting how it popped six out of six times since 2020. That sounds impressive, until you remember that the price of toilet paper also spiked in 2020. Does that make Charmin a risk-off asset?

The whole comparison to gold is a masterpiece of marketing nonsense. Gold has been a store of value for thousands of years. It’s a physical element you can hold in your hand. It’s stacked in vaults by governments who, despite their ability to print infinite money, still hoard the shiny yellow rock. Bitcoin, on the other hand, is a string of code whose value is based entirely on a collective agreement that it’s valuable. It’s a belief system. A digital religion.

Bitcoin isn't a hedge against a broken system. It's a funhouse mirror reflection of a broken system. It’s what you get when an entire generation has lost faith in every institution but still desperately wants to get rich quick. So, when BlackRock calls it a diversifier, what they're really saying is that it’s a great way to diversify your portfolio with pure, uncut speculation. But are we really supposed to believe that when the next real 1931-style crisis hits, the world is going to put its faith in an asset that can lose 20% of its value because of a tweet?

Don't Call It a Currency, Call It a Casino Chip

Let’s get one thing straight: Bitcoin will never, ever be a currency. The original whitepaper dream of a decentralized means of exchange is just that—a dream. It's a lovely, naive idea, like thinking billionaires are going to solve climate change.

No government on Earth is going to voluntarily give up its power to control the money supply. That’s their ultimate trump card. The article I read pointed out FDR’s “Great Confiscation” of gold in 1933. You think for a second they wouldn’t do the same to Bitcoin if it ever truly threatened the dollar? Please. It would be a political cakewalk. They’d just frame it as cracking down on terrorists and tax evaders, and half the country would applaud.

This is the part that drives me nuts. The whole "disruptive tech" narrative is such a lie. It’s the same pattern over and over. A cool, rebellious idea emerges from the fringes, promising to empower the little guy. Then, the moment it gets big enough to be a threat, the suits show up. They buy it, regulate it, and integrate it into the very system it was meant to destroy. It’s punk rock being sold at a mall kiosk.

That's what's happening to Bitcoin. It's not digital gold. It's the world's most sophisticated, high-tech casino chip.

You’re not investing in a future of finance. You’re placing a bet at a global roulette table. Your entire strategy is based on the hope that someone else, dumber or more desperate than you, will buy your chip for a higher price later on. The house, in this case, is the exchanges and the big investment firms like BlackRock, who skim their fees off every single transaction, win or lose.

This whole thing is a farce. No, farce is the wrong word—a farce is at least entertaining. This is just a slow-motion tragedy, and this latest all-time high is just another scene in the final act. Everyone is pretending it’s a revolution, when really, it’s just the same old game with a new…

Then again, maybe I'm the idiot. Maybe a $2.47 trillion market cap means it’s real now. Maybe I’m just too cynical to see the digital promised land. But when I see a record high followed immediately by a slump, it doesn’t look like the future to me. It looks like a gamble. And the house always wins.

So, We're All Just Pretending, Right?

At the end of the day, the price doesn't matter. The all-time high is just noise. What matters is that the narrative has been captured. Bitcoin is no longer a rebellion. It's an asset class, neatly packaged and sold to you by the same Wall Street giants it was supposed to render obsolete. The price hitting $124K isn't a victory for decentralization; it's the sound of the establishment cashing in on the revolution. And the saddest part is, everyone seems to be cheering them on.

Tags: bitcoin price today