It’s rare to see an asset defy gravity, especially when the broader market is wobbling like a fighter in the tenth round. Yet, that’s precisely the chart EVAA Protocol has painted. While most of the crypto world was busy consolidating or bleeding out, EVAA’s token price was carving out a new all-time high, reaching $7.94 before pushing even higher to over $10. The numbers are, on the surface, impressive: a price surge of over 200%—to be more exact, 211.3% in a recent seven-day period—and a top trending spot on CoinGecko.

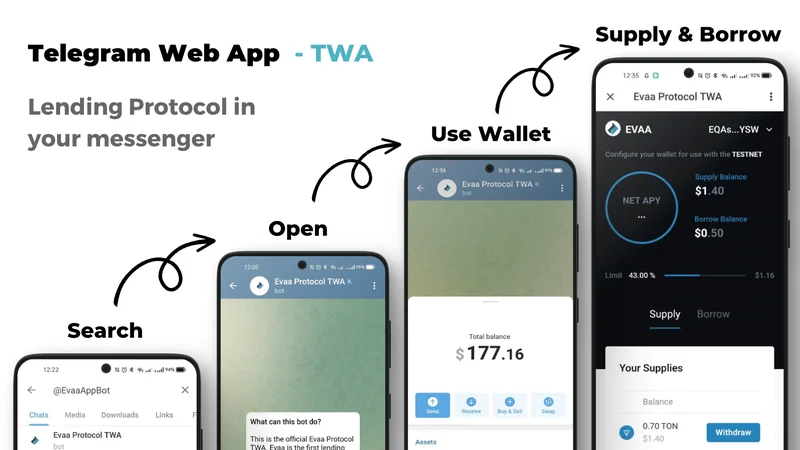

This is the kind of performance that gets attention. It’s clean, it’s aggressive, and it’s accompanied by a compelling narrative. EVAA isn’t just another decentralized finance (DeFi) protocol; it’s a DeFi protocol built on the TON blockchain and, crucially, integrated directly into Telegram as a Mini App. The vision is seductive: a seamless, user-owned financial layer inside one of the world’s most popular messaging apps. The project’s press releases are filled with bullish metrics and forward-looking statements about community governance. But my job isn’t to repeat the marketing copy. It’s to look at the numbers and ask if the engine can actually support the speed.

Deconstructing the Growth Narrative

Let’s start with the headline figures from the protocol’s October 27th announcement. EVAA reports having surpassed $1.4 billion in cumulative transaction volume and reached 300,000 wallets. These are large, satisfying numbers that look good in a press release. But as any analyst knows, the devil is in the definitions. "Cumulative transaction volume" is often a vanity metric. It’s like a restaurant boasting about every single meal it has served since its grand opening a decade ago, rather than telling you how many customers it had last night. It’s a big number that says very little about current, recurring activity.

What is the daily or weekly active user count? How many of those 300,000 wallets are genuinely active, and how many were created to farm an airdrop and now lie dormant? The provided data doesn't clarify. This lack of granularity makes it difficult to assess the protocol's actual, present-day health. Is this a bustling financial ecosystem or an empty stadium where the echoes of a few large, early transactions are being amplified?

This narrative was built on the back of a TON DeFi lender EVAA Protocol raises $2.5 million in private token sale to a roster of venture firms (including Animoca Ventures and TON Ventures). This is standard procedure. Early backers provide capital, and in return, they receive tokens at a significant discount. The subsequent public launch, token distribution, and marketing push create the liquidity and market demand necessary for these early positions to become profitable. There’s nothing inherently wrong with this model—it’s how the game is played. But it does mean we should view the accompanying narrative of "handing control over to the community" through a lens of healthy skepticism. The launch of a DAO and a governance token is as much a capital market event as it is a nod to decentralization.

The Mechanics of a Momentum Rally

When you strip away the narrative, you’re left with a price chart. And EVAA’s chart is a textbook example of a momentum-driven rally. After an initial post-listing dip, the token found a floor and then began a sharp, impulsive upward move. Technical analysts point to breakouts from parallel channels, bullish RSI and MACD indicators, and Fibonacci extension levels at $8.95 and $10.90. This is the language of price action, not fundamental value. It describes what is happening, but not necessarily why.

The "why" seems to be a perfect storm of a hot narrative (TON ecosystem, Telegram integration), a well-timed marketing push coinciding with the token launch, and the reflexive nature of crypto markets. Price goes up, which gets it on the "Top Trending" lists, which attracts more buyers, which pushes the price up further. It’s a cycle that can be incredibly profitable for those who get the timing right. The tokenomics, with revenue sharing via buy-backs and burns, are engineered to add fuel to this fire by creating a source of constant buy pressure.

And this is the part of the analysis that I find consistently fascinating. I've looked at dozens of these "governance transition" plans, and they almost always follow a predictable playbook. The language is about empowerment and decentralization, but the mechanics are about creating demand drivers for the token. The ability for token holders to vote on protocol parameters is real, but is that what’s driving someone to buy the token at a $68 million market cap? Or is it the hope that it will soon be a $100 million market cap? The answer seems fairly obvious. The question that remains is whether the underlying protocol can grow its actual utility fast enough to eventually justify the valuation the market has speculatively assigned to it.

A Momentum Play in a Utility Wrapper

Let's be clear: the EVAA Protocol may well become a foundational piece of the TON DeFi ecosystem. The idea of a liquidity layer inside Telegram is powerful, and the team has secured partnerships and funding that suggest a serious long-term effort. But the current market activity surrounding its token is not a reflection of that utility. Not yet.

What we are witnessing is a classic, well-executed crypto momentum play. It has all the necessary ingredients: a compelling story, a low-float new token, venture backing, and a price chart that screams "up only." The narrative about decentralization and community ownership is the wrapper, but the product being sold right now is speculative momentum. The valuation is not being driven by transaction fees or protocol revenue, but by the expectation that someone else will buy the token at a higher price tomorrow. This isn't a criticism, merely an observation of the market's nature. The real test for EVAA will come not next week or next month, but in the quiet period after the hype fades. Will the users, the transactions, and the revenue show up to support the price? Or will the hot money simply move on to the next story?

Tags: EVAA Protocol