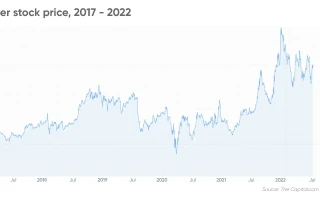

Alright, let's cut the crap. For the last five years, Pfizer has been the stock market equivalent of that uncle who peaked in high school. It had its one glorious moment with the COVID vaccine, and ever since, it’s been a slow, painful slide into mediocrity, with investors avoiding it like the plague. The stock’s been cheap, sure, but so is a gas station hot dog, and you don’t see people lining up to bet their retirement on that, either.

Then, out of nowhere, in late September, the stock chart suddenly looked like it got a shot of adrenaline. A 15% jump in a week? For Pfizer? The whole thing stinks.

Wall Street and the PR machine are spinning this as a grand turnaround story. They’re pointing to two big, flashy moves that are supposed to convince us that the old, lumbering giant is suddenly nimble and brilliant. First, a "landmark" deal with the Trump administration on drug pricing. Second, a massive $7.3 billion bet on the weight-loss drug craze.

I'm not buying it. Not for a second. This isn’t a comeback. It’s a magic trick—a classic misdirection designed to make you look at the shiny new objects while the foundation of the house is still quietly rotting away.

The Trump Deal is Just Good Ol' Fashioned Politics

Let’s get one thing straight about this "TrumpRx" deal. Pfizer didn't suddenly grow a conscience and decide to make drugs affordable for the American people. Give me a break. This is a company that, along with its peers, has perfected the art of squeezing every last cent out of the sick and desperate.

The real story is a whole lot simpler and a whole lot more cynical. The Trump administration was dangling a 100% import tariff over Big Pharma's head—a move that would have been catastrophic. So, Pfizer’s CEO, Albert Bourla, strolls into the White House, puts on his best serious face, and "agrees" to lower some Medicaid prices in exchange for making those tariffs go away. It’s a win-win for the powerful. Trump gets to stand at a podium and declare victory over drug prices, and Pfizer gets to protect its massive profits from a potentially devastating policy hit.

Who gets screwed? As usual, probably everyone else. This is like a mob boss offering a shopkeeper "protection." Pfizer paid a little bit of tribute to avoid a much bigger problem. Are we really supposed to applaud this as some kind of consumer-friendly breakthrough? It’s a backroom deal, plain and simple, a masterclass in corporate lobbying disguised as public service. It removed a "political risk" for investors, sure, but it solves none of the underlying, systemic issues with drug pricing. It just papers over them for a news cycle.

Chasing the Obesity Dragon

Then there's the second act of this little play: the $7.3 billion acquisition of Metsera to get into the weight-loss game. This is Pfizer’s attempt to crash a party that’s already in full swing. Eli Lilly and Novo Nordisk are the rock stars here, with drugs like Zepbound and Ozempic printing money and changing the entire industry.

And now Pfizer, after its own in-house obesity drug failed because of safety issues, is throwing billions at a smaller company hoping to catch up. This isn't innovation. This is panic. No, 'panic' doesn't cover it—this is the most expensive case of corporate FOMO I've ever seen. They’re like an aging band that sees TikTok is popular and suddenly releases a soulless dance track. It’s embarrassing.

The early data from Metsera looks "promising," matching the results of drugs already on the market. Great. So they're spending over seven billion dollars to hopefully, maybe, in a few years, release a me-too product into a market dominated by two behemoths who have a massive head start. What happens if their trials hit a snag? What if the side effects are worse? What if, by the time they get to market in 2026 or 2027, the entire landscape has shifted again? It’s a huge gamble, and it does absolutely nothing to help them with the problems they face right now.

The upcoming earnings report on November 4 is where this fantasy narrative is going to collide with reality, leaving many to ask, Should You Buy Pfizer Stock Before Nov. 4? Analysts expect earnings to drop—a lot. The "COVID cliff" is real. The billions they made from vaccines and Paxlovid are evaporating, and nothing in their current pipeline, not even the impressive oncology drugs from the Seagen acquisition, can fill that hole quickly enough.

They’ll talk about their cost-cutting program and their robust pipeline, and they’ll dangle that fat 7% dividend yield in front of you like a shiny lure. That dividend is the cheese in the mousetrap, folks. It’s designed to get you to ignore the fact that the company’s core revenue engine is sputtering. And offcourse, some institutional investors are nibbling, as seen in a recent Fund Update: Janney Montgomery Scott LLC opened a $51.4M position in PFE stock. But for every fund buying in, another is quietly selling off shares. It ain't a sign of universal confidence.

This whole thing feels... desperate. The political maneuvering, the trend-chasing acquisition—it’s all noise. It’s sound and fury designed to distract from the simple fact that Pfizer's golden goose is cooked, and they're not sure where the next one is coming from.

It's a Band-Aid on a Bullet Wound

Let's be real. The recent stock rally is built on hope and hype, not fundamentals. A sweetheart deal with a politician and a Hail Mary pass into the obesity market don't magically erase the patent cliffs coming for blockbusters like Eliquis. They don't fix the post-COVID revenue collapse. Pfizer is an old battleship trying to turn around in a tiny canal, and all this recent activity is just the crew frantically waving flags on the deck to make it look like they’re speeding up. I’m not buying it, and unless you have a stomach for high-stakes corporate theater, you probably shouldn't either.

Tags: pfe stock