Decoding the Fed's Dovish Signal: A Contradiction in the Data

The market had been holding its breath for one thing: the minutes from the Federal Reserve’s September meeting. Against a backdrop of a protracted U.S. government shutdown and political turmoil rattling Europe and Japan, traders were looking for a clear signal. What they got was a signal, but the market's reaction suggests it was listening to a completely different frequency.

The context leading up to the release was already a mess of contradictions. The U.S. dollar index (DXY) was riding high, touching levels not seen in two months. But this wasn't a story of American economic triumph. It was a story of relative safety. With political uncertainty weighing on the euro and the yen—two currencies that comprise a massive 71% of the DXY—the dollar became the default choice. The ongoing government shutdown in Washington, which should theoretically be a negative, was paradoxically working in the dollar's favor by suspending the release of potentially negative jobs data.

Meanwhile, the real indicator of fear was screaming from the commodities desk. Gold blew past the historic $4,000 per ounce mark. This wasn't a subtle move; it was a fifty-percent surge on the year. Central banks, led by the People's Bank of China, were accumulating the metal, and investors were piling into the perceived safety of bullion. It was a classic flight to safety. The question was whether the Fed's minutes would calm the waters or churn them further.

The Signal Was Unmistakably Dovish

When the minutes finally dropped on October 8th, the text itself was unambiguous. The Federal Open Market Committee was leaning toward more easing. The document was littered with cautious language pointing to a dovish stance. "Most participants judged it would likely be appropriate to ease policy further over the remainder of 2025," the summary stated. This wasn't a hawkish committee wrestling with inflation; it was a committee increasingly concerned about the other side of its mandate.

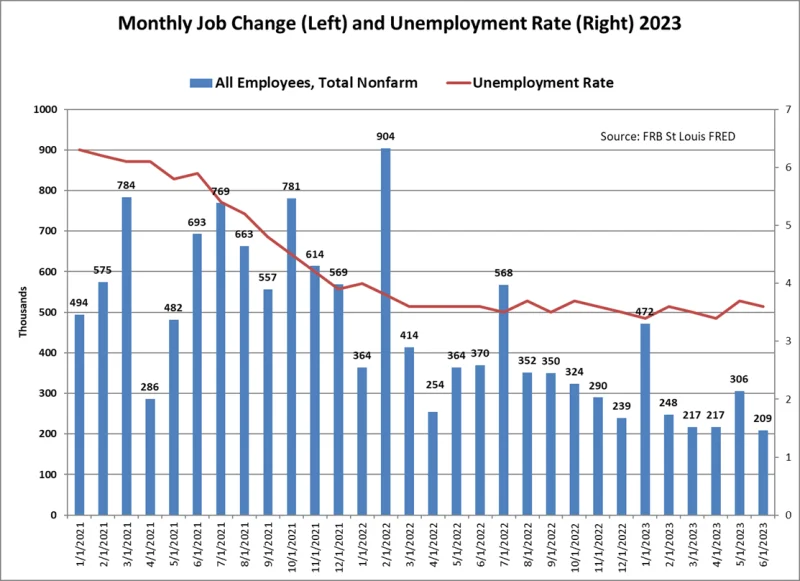

The discussion reflected a clear shift in the balance of risks. "Most participants judged downside risks to employment to have increased," the minutes noted, while inflation risks had "either diminished or not increased." This is the kind of language that typically sends a currency downward. It signals a central bank prioritizing job growth over fighting inflation, which implies a lower-for-longer interest rate environment.

The internal vote count tells the same story. While a few participants could have supported holding rates steady, the consensus was firmly behind the quarter-point cut. In fact, the pressure was skewed toward even more aggressive action. One participant, Governor Stephen Miran, argued for a half-percentage-point cut. So, the committee's center of gravity wasn't just dovish; it had a dovish outlier pulling it even further. There was simply no credible hawkish interpretation of this text. The Fed was worried about the labor market, and it was preparing to act.

The Dollar's Defiance Tells the Real Story

And then came the market reaction. In the face of this clearly dovish report, the U.S. dollar didn't just hold its ground; it strengthened. The DXY pushed further north of the 99.00 hurdle, hitting fresh two-month highs. This is where the simple cause-and-effect model breaks down. A central bank signals more easing, and its currency rallies. How does this compute?

It doesn't, if you assume the market is trading on U.S. fundamentals. I've analyzed market reactions to Fed minutes for over a decade, and a textbook dovish release followed by a stronger dollar is a significant anomaly. This reaction defied the conventional wisdom that dovish minutes would hurt the dollar, an expectation seen in headlines like FX Daily: Fed minutes can throw cold water on USD rally. It tells you the market isn't trading on the Fed's domestic intentions. It's trading on something else entirely.

That "something else" is the global macro picture. The dollar's strength is an illusion created by the DXY's composition. With the euro and yen facing their own political headwinds—a budget deadlock in France and a new, dovish leader in Japan—the dollar wins by default. It’s like a race where the two lead runners trip and fall, allowing the third-place runner to coast to victory. The dollar isn’t running faster; its competitors are just running slower. The DXY is heavily weighted toward these currencies (a combined 71% for EUR and JPY), making it a poor gauge of pure U.S. economic sentiment in moments like this.

This is the core discrepancy. The Fed is looking inward, at a slowing U.S. labor market. The currency market is looking outward, at global political instability. The government shutdown only amplifies this dynamic by masking potential U.S. weakness. Without official data on jobs or inflation, traders are left with a void, and they're filling it with fears about Europe and Asia. The dollar isn't being bought; it's simply the place to hide. The real tell isn't the DXY—it's the price of gold, which is hedging against the dysfunction of the entire system.

The Market Is Trading on Fear, Not Fed Policy

Let's be clear. The FOMC minutes from the September meeting were a straightforward document. They painted a picture of a cautious central bank, increasingly concerned about employment risks and prepared to cut rates further. By any conventional measure, this should have been a headwind for the U.S. dollar. The fact that the opposite occurred is the most important data point of all. It signals that the dollar's value is currently decoupled from the Federal Reserve's policy intentions. The market isn't pricing in a robust U.S. economy. It's pricing in a chaotic global landscape where the dollar, despite its own domestic troubles, remains the least-bad option. The dollar's rally isn't a vote of confidence; it's a vote of no-confidence in everything else.

Tags: fomc minutes