The market doesn’t like surprises. On Friday, it got a big one, and the reaction was as swift as it was predictable. The S&P 500 shed nearly 2%, the Dow fell 1.3%, and the tech-heavy Nasdaq took the biggest hit, dropping almost 600 points. The proximate cause was a social media post where, as one headline put it, Trump threatens to jack up tariffs on China over its new rare-earth controls.

This is the familiar rhythm of the new geo-economic landscape: a political threat is issued, algorithms parse the language for keywords like "tariff" and "hostile," and risk-off sentiment floods the market. The commentary, like the note from Wedbush’s Dan Ives calling it a "white-knuckle moment," focuses on the renewed tension.

But to focus solely on the tariff threat is to mistake the lightning for the storm. The real story isn't the loud, conventional response from the U.S. It's the quiet, surgically precise, and far more potent action from Beijing that triggered it. The market sold off on the headline, but I suspect it has yet to fully price in the structural risk embedded in the fine print of China's new policy.

The Anatomy of a Supply Chain Chokehold

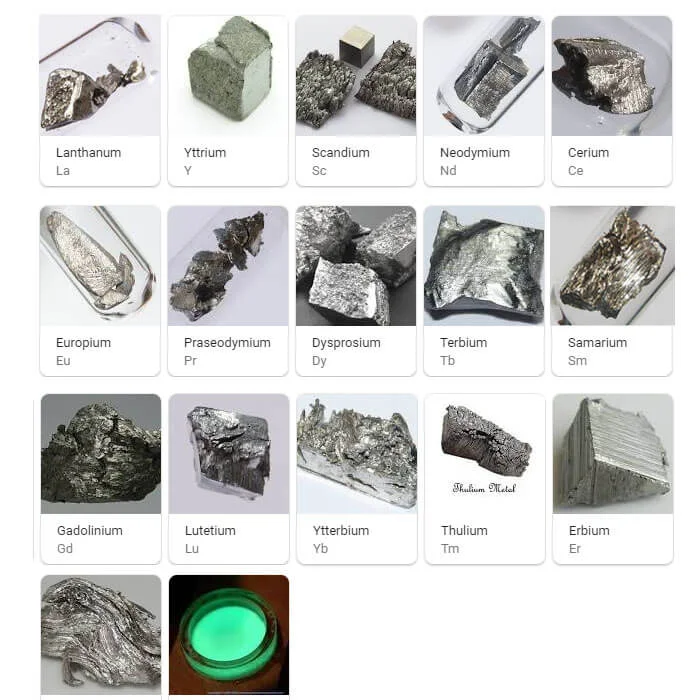

Let's be precise about what China actually did. This week, its Ministry of Commerce enacted new export controls on rare-earth elements. This, in itself, is not shocking. What is shocking is the scope. The new rules require special approval to export products containing even trace amounts of rare earths sourced from China. The critical clause, however, is this: the rule applies even if those products were manufactured abroad by non-Chinese companies.

This isn't a simple export ban. It's a declaration of sovereignty over a global supply chain.

To understand the leverage this creates, think of it less like a dam holding back a river and more like an invisible dye injected into its source. That dye flows downstream, through countless tributaries and channels, ending up in thousands of different lakes and reservoirs across the globe. China's new policy is the assertion that it now has the right to control any body of water containing even a single molecule of its dye.

When a single nation produces up to 95% of the world's rare earth magnets (a figure from Wood Mackenzie), that dye is in everything that matters to a modern economy: semiconductors, EV batteries, jet engines, and critical defense systems. A company in Germany making a specialized sensor for an American satellite might now need a license from Beijing to export its own product if it contains a magnet made with Chinese-sourced materials. The administrative reach is staggering. I've looked at hundreds of trade filings and export control notices over the years, and the language here is unusually, almost audaciously, broad. It's designed for maximum leverage, not just revenue.

What are the potential penalties for non-compliance? The English translation of the rules is conveniently silent on that point. This ambiguity is a feature, not a bug. It creates uncertainty, and uncertainty forces compliance. Why risk having your global shipments seized over a technicality?

Mispricing an Asymmetric Threat

The market’s reaction, a drop of about 2.6%—to be more exact, 2.59% for the Nasdaq—reflects a pricing-in of renewed trade friction. It’s a familiar pattern. Traders are calculating the potential impact of new tariffs on corporate earnings and adjusting valuations accordingly. This is a linear, quantifiable risk.

But is that the correct risk to be measuring?

Trump's threat of tariffs is a conventional weapon. It's a bludgeon that raises costs across the board. China's move is asymmetric. It’s a scalpel that can be used to selectively paralyze specific companies, industries, or even defense programs at will. The policy doesn't ban anything outright; it creates a system of discretionary approval. It establishes a mechanism for turning the supply chain on and off for any given target, at any time, with plausible deniability.

The sell-off on Friday was a reaction to the bludgeon. The market understands bludgeons. It has models for them. What I'm not convinced of is whether it has a model for the scalpel. What happens if Beijing, citing administrative backlog, simply delays export licenses for components essential to U.S. defense contractors? Or for the magnets required by a specific EV manufacturer that has been critical of Chinese policy? The impact wouldn't be a generalized 2.6% dip; it would be a catastrophic failure for that specific entity.

This follows a period of relative calm (and a framework deal announced in June), which likely amplified the shock. But the market seems to be reacting to the disruption of that calm, not the introduction of a fundamentally new and more dangerous tool of economic statecraft. The question investors should be asking isn't "What will higher tariffs do to Q4 earnings?" but rather, "What is the systemic risk when a single government holds a veto power over key components in nearly every advanced industry on the planet?"

A Calculated Asymmetry

The entire episode reveals a fundamental divergence in strategy. Trump’s threat is loud, public, and symmetric—tariffs beget tariffs. It’s a tool of brute force. China’s export control policy is quiet, bureaucratic, and asymmetric. It’s a tool of precise leverage. The market reacted to the noise of the familiar threat, but the real, unpriced risk lies in the silent, structural power of the new one. One is a shotgun blast; the other is a sniper's rifle. And right now, everyone is staring at the guy with the shotgun, while the sniper quietly gets into position.

Tags: rare earth minerals