The move from Beijing was, to anyone watching the numbers, inevitable. On Thursday, China’s Ministry of Commerce announced it was tightening export controls on an additional five rare-earth metals, bringing the total number of restricted elements to twelve out of a possible seventeen (China tightens export controls on rare-earth metals: Why this matters). The official statement cited "national security interests," a familiar and conveniently opaque justification.

But let's be clear. This wasn't a routine administrative update. This was a precisely calibrated signal sent just weeks before President Trump is scheduled to meet with President Xi. It’s a strategic maneuver designed to expose a critical economic and military vulnerability at the exact moment of maximum diplomatic leverage. The timing isn't a coincidence; it's the entire point.

For years, the discourse around US-China relations has centered on trade deficits, tariffs, and intellectual property. While important, those issues are symptoms. The underlying disease is dependency. And in the world of critical materials required for modern technology and defense, the dependency is almost absolute. I’ve analyzed supply chain dependencies for years, and this level of concentration in a single state actor is a textbook case of strategic risk that has been ignored for far too long.

A Dependency Measured in Megatons and Billions

To understand the power of this move, you have to look past the political theater and focus on the raw data. China currently mines over 60% of the world's rare earths. More critically, it controls the processing of approximately 90% of them. This is the industrial equivalent of controlling all the world's oil refineries, regardless of where the crude is drilled. The raw material is one thing; the ability to turn it into something usable is everything.

The United States is the most exposed. Between 2020 and 2023, the US sourced 70% of its rare earth compounds directly from China. In 2023 alone, that amounted to about $23 million—$22.8 million, to be exact—making the US the largest single importer of these materials from China. While that dollar figure may seem small in the context of a multi-trillion-dollar economy, it’s a dangerously misleading metric. It’s like measuring the value of a spark plug by its price instead of its function in a billion-dollar jet engine.

And that’s precisely where the real vulnerability lies. These aren't just elements for making electric car batteries or LED screens. They are indispensable components for the crown jewels of the US military arsenal. We’re talking about the guidance systems in Tomahawk missiles, the radar arrays on F-35 fighter jets, and the sonar systems in Virginia-class submarines. Gracelin Baskaran at CSIS correctly notes this move undercuts US efforts to bolster its industrial base. The problem is, that base has been allowed to atrophy for decades. What does it say about strategic planning when the components for your most advanced defense platforms are sourced from your primary geopolitical rival? How does a nation project power when its supply chain for power projection is held captive?

China’s action is less like a sudden attack and more like a creditor calling in a loan that everyone knew was overdue. Beijing is simply leveraging an asymmetry it has patiently cultivated for over two decades while the West chased cheaper manufacturing costs. The argument that these materials could be used for "sensitive applications" by foreign entities isn't just a justification; it's a blunt statement of fact. The most sensitive applications imaginable—from smart bombs to stealth fighters—rely on a supply chain that begins and ends in China.

The Calendar as a Weapon

The most elegant part of this strategy is its timing. The new restrictions on elements like holmium, erbium, and europium don't take effect until December 1, 2025. This creates a roughly two-and-a-half-month window. It’s not an embargo; it’s a countdown timer placed squarely on the negotiating table ahead of the APEC summit.

This delay serves two purposes. First, it avoids the immediate economic shock that could trigger a massive global backlash, allowing China to maintain a veneer of reasonableness. The Ministry of Commerce spokesperson was quick to promise continued communication and cooperation, a standard diplomatic nicety that costs nothing. Second, and far more importantly, it gives the US and its allies just enough time to fully comprehend the consequences of a potential cutoff, maximizing Beijing’s leverage in the upcoming talks.

The message to Washington is unambiguous: your tariffs on our goods are a problem for our economy, but our control over rare earths is a threat to your national security. This transforms the negotiation from a simple trade dispute into a matter of fundamental strategic importance. What concessions might the US be willing to make on semiconductor restrictions or tariffs when the production of its next-generation military hardware is on the line?

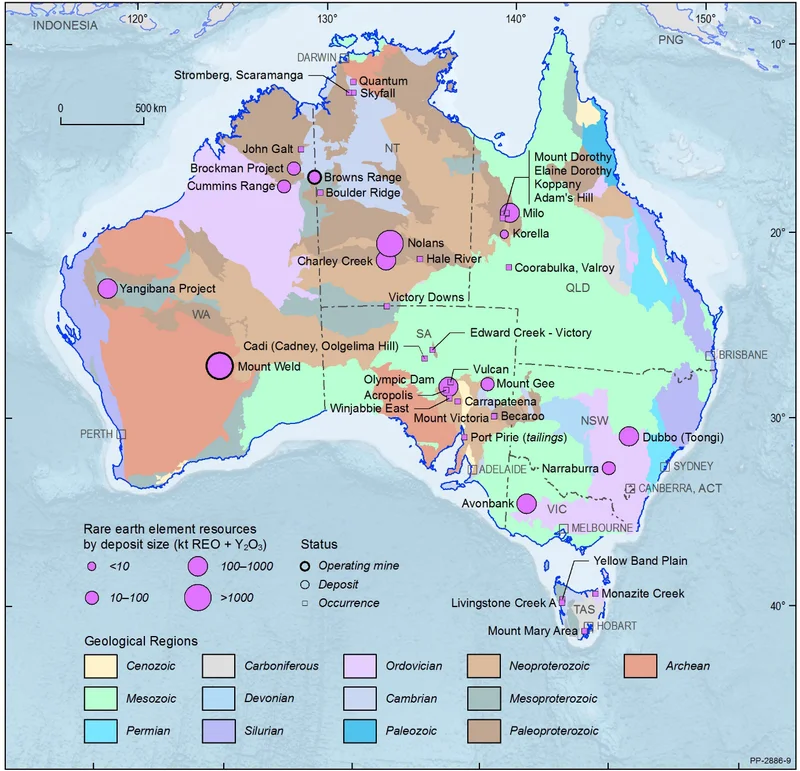

This forces a series of uncomfortable questions that have been kicked down the road for years. Can the US and its allies build a non-Chinese rare earth supply chain? Yes, in theory. But it would take the better part of a decade and hundreds of billions of dollars in investment to replicate the mining and (more significantly) the complex processing infrastructure that China dominates. The capital investment is one thing, but the environmental regulations and technical expertise present far higher barriers to entry. Are there alternative sources? Yes, but none that can scale quickly enough to fill the void left by China. This isn't a switch that can be flipped overnight.

The Real Deficit Isn't in Dollars

The narrative of the last few years has been dominated by the US restricting China's access to advanced semiconductors. That was a move from a position of strength. This rare earths announcement is the perfectly symmetrical countermove, executed from China's own unique position of strength. It’s a stark reminder that supply chains are now the primary battlefield of the 21st century.

My final analysis is this: Beijing’s move isn't just a tactic for the next round of trade talks. It is the public unveiling of a checkmate strategy that has been in development for years. The US has been focused on a trade deficit measured in dollars, while ignoring a far more dangerous strategic deficit measured in critical materials. The upcoming negotiations won't be about reaching a fair deal; they will be a clear demonstration of the price of that dependency. The numbers have been telling this story for a long time. Now, it seems, someone in Washington is finally being forced to listen.

Tags: rare earth minerals