The 6% Mirage: Why Today's Mortgage Rates Aren't the 'Relief' You Think They Are

The numbers flashing across screens this morning show the average 30-year fixed mortgage rate at 6.156%. On the surface, it’s a moment of quiet stability. There’s been almost no change from the day prior, and we’re down from the 6.327% we saw a month ago. After a brutal stretch where rates seemed permanently tethered to the 7% mark, this slow drift downward feels like a collective exhale for the housing market.

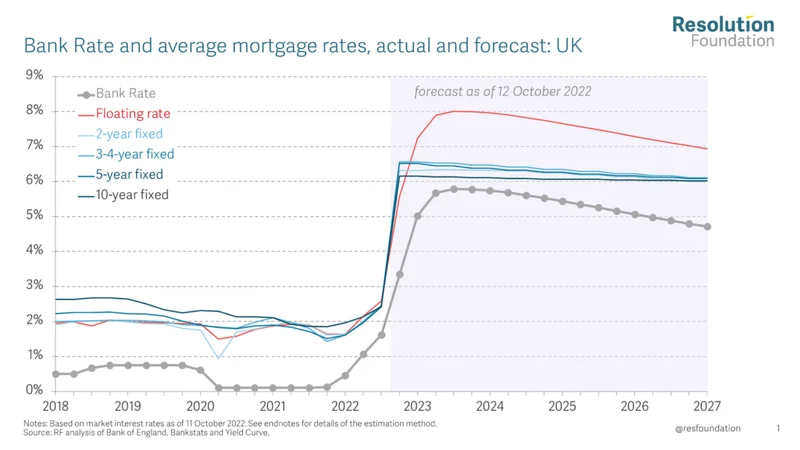

But don’t mistake a pause for a pivot. This isn't relief; it's acclimatization. The market isn’t healing, it’s just learning to live with the pain. We are witnessing the slow, grinding acceptance of a new reality, one where the intoxicatingly cheap money of the pandemic era is a historical artifact. The data doesn't suggest a V-shaped recovery for affordability. It points to a long, flat, and challenging plateau.

Deconstructing the New Normal

Let's be precise with the data. The current 30-year conventional rate of 6.156% is a world away from the historic low of 2.65% recorded in January 2021. That sub-3% environment was an anomaly, a massive, government-induced economic stimulus designed to ward off a complete collapse. It was financial adrenaline injected into a patient in shock. The problem is, you can't live on adrenaline forever. What we're seeing now is the market's natural, and much higher, resting heart rate.

This reversion to the mean has created a powerful market distortion, a phenomenon now widely known as the "golden handcuffs." Millions of homeowners are sitting on mortgages with rates in the 2s and 3s, effectively locking them in place. To move would mean trading a historically cheap loan for one that is double the cost, a financially ruinous proposition for most. I've analyzed housing cycles for two decades, and this level of inventory paralysis, driven almost entirely by rate differentials between existing and new loans, is functionally unprecedented. It’s a statistical traffic jam on a national scale, and it’s choking supply.

The various loan types tell their own stories. While conventional loans hover above 6%, government-backed loans offer slightly better terms. A 30-year FHA loan is currently at 5.968%, while a VA loan is even lower at 5.720%. These figures represent the market’s attempt to segment risk and provide pathways for different types of buyers, but they all orbit the same gravitational center. The days of casually securing a loan under 4% are, for the foreseeable future, over. The real question isn't whether rates will fall back to 3%, but whether 5.5% is the new floor.

The Fed's Delicate (and Misleading) Dance

Much of the recent optimism, however muted, has been tied to the Federal Reserve. The central bank delivered a quarter-percentage-point cut at its September meeting, a move that prompted many to ask What this Fed rate cut means for your credit card, mortgage, auto loan, student debt and savings account. With two more meetings on the calendar for 2025, there's speculation of further easing. This has led many to believe a clear path to lower `mortgage interest rates` is finally opening up.

This is a fundamental misreading of the mechanics. The Fed's short-term federal funds rate is not a direct lever for long-term mortgage rates. It's more like a suggestion. `30 year mortgage rates` are priced off the 10-year Treasury yield, which is influenced far more by long-term expectations for inflation and economic growth. The recent Fed cut did little to move the needle. In fact, rates dropped slightly leading up to the meeting—to be more exact, the 30-year conventional rate barely budged post-announcement, while some government-backed loans saw a more noticeable, but still modest, dip.

What the market often ignores is the Fed's other lever: its balance sheet. For years, the Fed was a massive buyer of mortgage-backed securities (MBS), which artificially suppressed rates. Now, it's letting those assets mature and roll off without replacement (a policy of quantitative tightening). This action quietly exerts upward pressure on rates, effectively counteracting some of the impact of its highly publicized rate cuts.

This creates a critical disconnect. If a Fed rate cut doesn't translate into tangible relief for the average homebuyer, what is its primary purpose? Is it more about managing market psychology than altering the financial reality for households? And as we look toward the next two meetings, will we just see more of the same—gentle nudges that fail to move the mountain of housing costs?

While macroeconomics dictate the environment, an individual's financial profile determines their fate within it. The standard advice holds true, now more than ever: a top-tier credit score (think 740 or higher) and a low debt-to-income ratio (ideally below 36%) are your best defenses. Imagine sitting in a loan officer's quiet office, the only sound the soft click of a keyboard. The rate that flashes on their screen won't be the one from the online banner ad; it will be a number tailored precisely to your perceived risk. That number can vary wildly from the "average" reported by data aggregators like Optimal Blue.

This brings up a crucial methodological question: who is the "average" borrower these statistics are based on? They often assume an ideal applicant with a high credit score and a significant down payment. For the median American buyer, the actual offered rate could be substantially higher. The gap between the advertised rate and the rate one actually qualifies for is where affordability dreams go to die. Shopping among multiple lenders isn't just a good idea; it's a financial necessity that Freddie Mac estimates could save a borrower over a thousand dollars a year. It's one of the few variables left that you can actually control.

The Anomaly Is Over

Let's be perfectly clear. The obsession with a return to 3% or 4% mortgage rates is a dangerous market fantasy. The data from the last 40 years shows that the 2020-2021 period was the historical outlier, not the 6-7% rates of the last 18 months. The fundamental repricing of capital is complete. The real story isn't the daily fluctuation of a few basis points; it's that the baseline has shifted permanently higher. Homebuyers, sellers, and investors need to stop waiting for a rescue that isn't coming. The math has changed, and the anomaly is over.

Tags: mortgage rates today