It’s easy to get lost in the noise right now. Turn on your screen and you’ll see the sea of red. Bitcoin is hovering near $108,000, struggling below a key technical level. Crypto Prices Slip Ahead of US Jobs Data as Bessent Flags Rate Risks. Treasury Secretary Scott Bessent is on CNN, using words like “recession” and talking about the strain of high interest rates. You see headlines about BlackRock’s flagship Bitcoin ETF shedding hundreds of millions in a single day. It feels heavy. The air is thick with caution.

And if you stop there, you’ll miss the entire story.

Because while everyone is fixated on the flickering red lights of the daily charts, something far more profound, far more permanent, is being built right under our noses. We're watching the frantic, messy, and absolutely thrilling construction of a new financial layer for our world. To focus on today's price is like judging the architectural significance of a cathedral by looking at a single misplaced brick on a Tuesday afternoon. You're missing the point entirely.

The Signal Hiding in Plain Sight

Let’s talk about what really matters this week. It’s not the dip. It’s the launch.

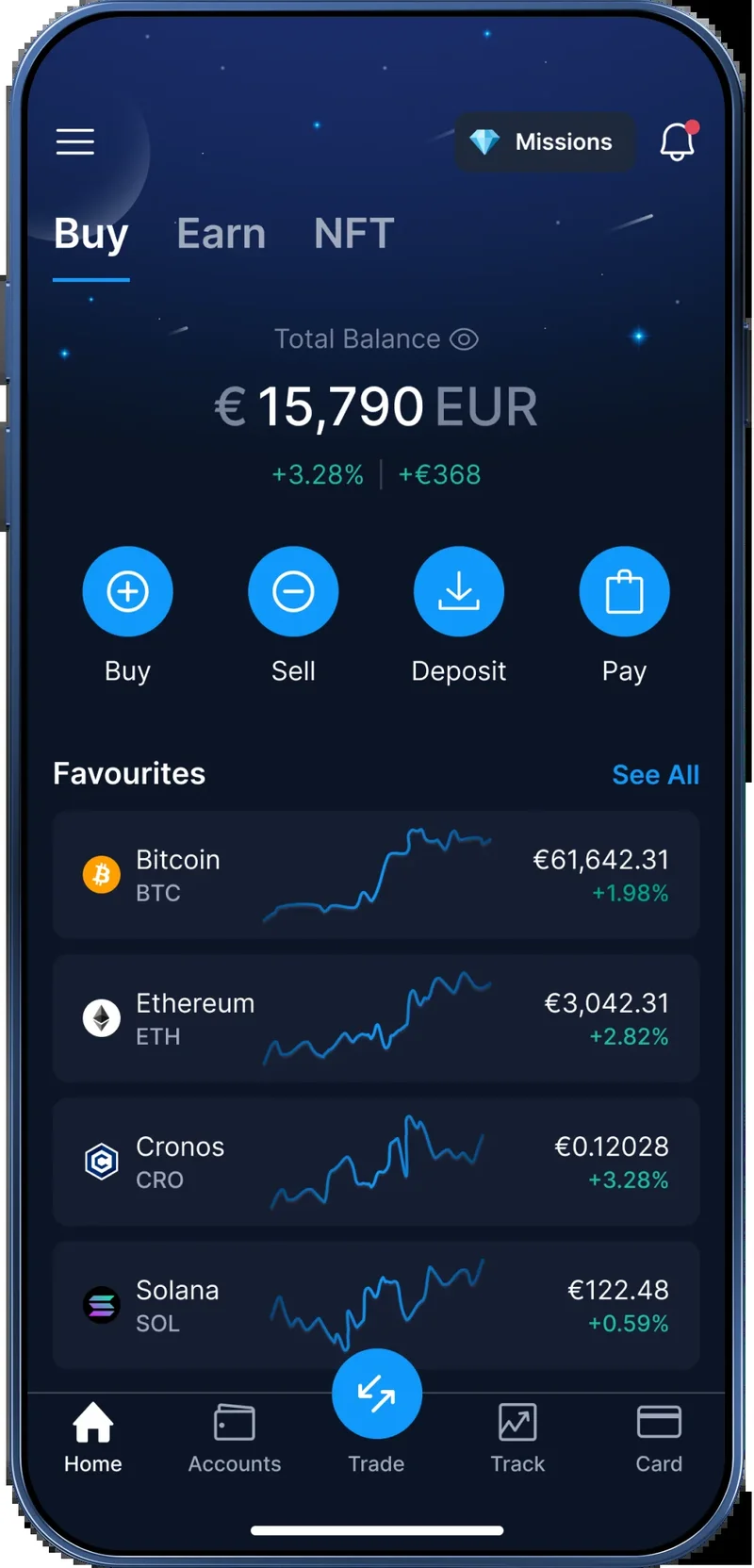

While the titans of Bitcoin and Ethereum were taking a breather, Crypto’s second wave of ETFs arrives as investors snap up Solana product. These aren't just any ETFs. We're now seeing funds for assets like Solana, Hedera, and Litecoin. For years, accessing these assets meant navigating crypto exchanges, managing private keys, and taking on a level of technical risk that kept most people on the sidelines. Now, it’s as easy as buying a share of Apple. As one Bloomberg analyst perfectly put it, “For investors, this is about as McDonald’s easy as you can get.”

When I first saw the numbers for the new Bitwise Solana Staking ETF (BSOL), I honestly just sat back in my chair, speechless. In its first few days, it pulled in staggering volume, becoming the best ETF launch of 2025 across any asset class. This wasn't some niche crypto event; this was a mainstream financial breakout. Think about that. The demand wasn't just there; it was ravenous. This is the kind of breakthrough that reminds me why I got into this field in the first place.

Do you remember the decade-long, brutal fight just to get a Bitcoin ETF approved? The lawsuits, the rejections, the endless debate? Grayscale literally had to sue the SEC to make it happen. Now, just a couple of years later, we're seeing an explosion of new products for a diverse range of digital assets launching with such ferocious demand—it’s a paradigm shift happening at a speed that is almost hard to process, a clear signal that the financial world has finally, irrevocably, accepted that this technology is here to stay.

What does this tell us? It tells us that while traders worry about Friday’s jobs report, a much larger wave of capital is getting its surfboard ready. The debate is no longer if crypto will be a part of the traditional financial system, but how quickly it will be integrated. Are we really going to let a 3% dip in Ethereum distract us from that?

We're Building Financial Superhighways

For years, investing in the crypto ecosystem was like trying to navigate a country with nothing but winding, unpaved back roads. It was an adventure, sure, but it was slow, risky, and reserved for the dedicated few who knew the terrain. You had to be an enthusiast, a pioneer willing to get a little mud on your tires.

These ETFs are not just another road. They are the financial equivalent of the interstate highway system.

They are massive, regulated, multi-lane superhighways being paved directly into the heart of the digital economy. They connect every brokerage account, every retirement fund, and every mom-and-pop investor directly to this new asset class. This isn't just about making prices go up. This is about building permanent infrastructure. It’s about creating the pipes and the plumbing that will allow value to flow into this ecosystem for decades to come.

The launch of a Solana ETF is a particularly crucial milestone. It signals a maturation of the market beyond the two giants. It’s the system acknowledging that this isn't just a story about Bitcoin as digital gold or Ethereum as a world computer. It's an entire ecosystem of innovation, and the market wants exposure to all of it. This uses a financial wrapper—in simpler terms, it means packaging a complex digital asset into a simple stock-like share—to make it accessible to everyone.

So when I see the anxiety around Bitcoin failing to reclaim its $113,000 cost basis—a technical indicator showing the average price that recent buyers paid—I see a temporary traffic jam on one of these new highways. It's a short-term slowdown, but the highway itself is still there. And it's getting wider and longer every single day.

This is the moment where we have to ask ourselves a bigger question. What happens when this infrastructure is fully built? What new applications, new companies, and new forms of value will emerge when developers and entrepreneurs know they can build on platforms that are seamlessly connected to global capital markets?

This Is What The Foundation Looks Like

Let’s be perfectly clear. The nervous headlines about rate hikes and institutional outflows are just weather. They are passing storms. But the creation of these ETFs is climate change. It is a fundamental, irreversible shift in the environment. We are witnessing the financialization of a new technology in real-time, and it's happening faster than any of us could have imagined. The foundation is being poured, the steel is going up, and the blueprint is becoming a reality. Don't let a cloudy day convince you that the skyscraper isn't being built.

Tags: crypto